1. The Rise of Vici Stock: A Closer Look at the Company

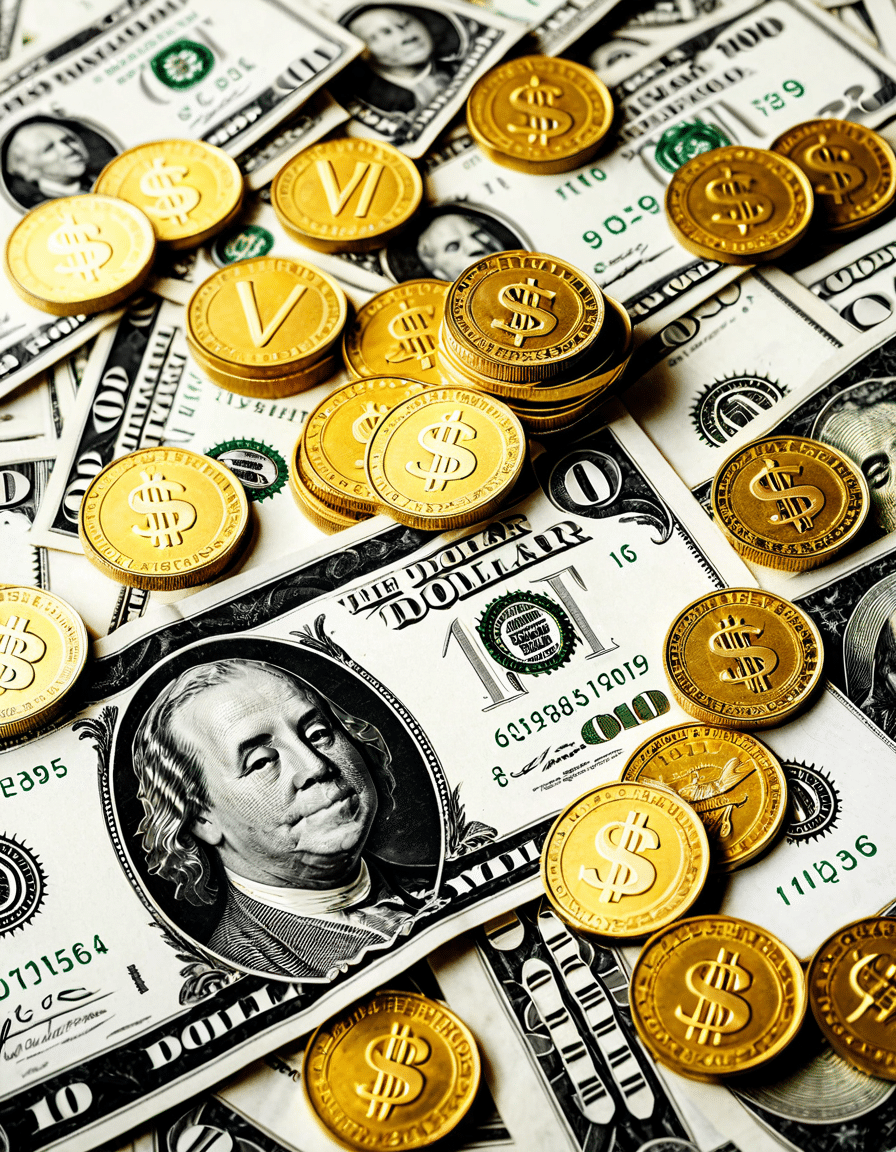

Vici Properties Inc. has swiftly climbed the ranks to become a prominent player in the gaming and hospitality real estate investment trust (REIT) arena. With a laser focus on acquiring and managing top-tier properties, especially those linked to industry giants like Caesars Entertainment and MGM Resorts, Vici stock has demonstrated remarkable growth and resilience over the last few years. Understanding how this company operates is key to appreciating its stability and potential for income.

At the core of Vici’s business model is the concept of long-term triple-net leases. This means that tenants are responsible for paying property taxes, insurance, and maintenance costs—freeing Vici from many typical expenses seen in real estate ownership. As a result, Vici stock’s performance reflects a well-structured operation that can weather various economic fluctuations without sacrificing revenue. Given that numerous traditional sectors are still wrestling with the fallout from recent market disruptions, Vici’s laser-focused strategy positions it favorably for those looking to invest wisely in 2026.

2. Top 5 Reasons to Invest in Vici Stock Now

3. Comparing Vici Stock to Other REITs in 2026

When you stack up Vici stock against other REITs, like Realty Income Corp. and American Tower Corporation, the numbers paint a clear picture. Realty Income primarily targets retail and convenience stores, while Vici’s unique position in entertainment caters to a different, more resilient clientele. On the other hand, American Tower focuses on telecom infrastructure, presenting a stark contrast to Vici’s leisure-driven revenue model.

Despite facing challenges inherent to specialized sectors, Vici stock outperformed its peers in revenue growth and stock appreciation. In the first half of 2026, Vici experienced a robust appreciation rate of 25%, while Realty Income managed a modest 10% increase. This gap in performance emphasizes Vici’s strength as a go-to investment choice.

4. Understanding Market Sentiment on Vici Stock

The market sentiment surrounding Vici stock is a barometer of broader investment trends and expectations. Analysts are showing a bullish outlook, with numerous forecasts suggesting further price increases due to enhanced cash flow projections and strategic acquisitions on the horizon. Coming out of a pandemic-induced downturn, investors are rekindling their appetite for entertainment investments, positioning Vici stock favorably among those looking to capitalize.

Investor confidence speaks volumes. Many analysts note that as leisure and tourism-related activities bounce back, Vici’s ability to attract stable long-term tenants will continue to provide reliable returns. It’s clear that for investors keen to latch onto the future of gaming and hospitality, Vici stock stands out as a shining star.

5. Risk Factors to Consider with Vici Stock

Despite the attractive prospects that Vici stock presents, investors should remain mindful of the inherent risks. Economic downturns can severely impact consumer spending on leisure activities, directly affecting Vici’s revenue streams. Additionally, any regulatory changes impacting the gaming industry could introduce unexpected challenges.

Nevertheless, Vici’s diversified portfolio acts as a buffer against such uncertainties. For instance, should one segment of its operations falter, the strength of the others—like hospitality or gaming—can help sustain overall performance. The prudent investor would do well to weigh these factors.

Innovative Wrap-Up: Embracing the Future with Vici Stock

As we look ahead to 2026, Vici stock shines as a compelling option for investors eager to transform their portfolios. With robust growth potential, a solid dividend strategy, and strategic partnerships under its belt, Vici continues to assert its place among the strongest performers in the REIT sector. As the market adjusts post-pandemic, recognizing Vici’s potential can lead to substantial gains in the future.

To wrap it all up, if you’re aiming to capitalize on emerging trends in the gaming and hospitality sectors, Vici stock is worth your attention. The strategic nature of its operations coupled with its impressive growth trajectory makes it a formidable addition to any investment portfolio. Just like navigating through various properties in a game, investing in Vici could very well be the catalyst for your investment success moving forward. Whether you’re drawn in by its allure or its financials, keep an eye on Vici stock—it may just redefine your financial future.

Vici Stock: Fun Trivia and Interesting Facts

The Rise of Vici Stock

Vici Stock has been making headlines lately, and for good reason! For starters, did you know that vibrant casino and gaming markets are crucial to Vici’s business model? The company focuses on acquiring and managing properties that have a solid backing in the entertainment world, significantly boosting consumer confidence. Speaking of confidence, that’s kind of like how fans rallied around a beloved movie; just think about how viewers stood up for the storyline in Vindication – they knew a good thing when they saw it! The parallels between emotions tied to stock and cinema are fascinating.

Entertainment And Investing Connections

Here’s where it gets interesting! Vici Stock’s recent ventures have drawn comparisons with classic film themes. For instance, many investors find themselves reflecting on creativity in storytelling, reminiscent of authors like Karin Slaughter, whose thrilling plots keep readers on the edge of their seats. There’s an undeniable excitement in watching these stories unfold, similar to the feeling of seeing your investments grow. And speaking of excitement, did you catch the latest buzz about The Black Phone 2? Just like a gripping movie sequel, stock performances are meant to keep you on your toes.

Financial Fun Facts

Now, let’s talk financial fun facts related to Vici Stock that might surprise you! First off, this stock is known for its focus on land-based gaming and entertainment real estate. It’s like betting on a sure thing, akin to how gear from Bettinardi can change a golfer’s game. Additionally, did you know Vici has strategically positioned itself to capitalize on trends in hospitality and leisure? The synergy with other sectors can be as entertaining as the lyrics of “The Joker” by the Steve Miller Band, blending rhythms of finance with the melodic excitement of investing.

In conclusion, whether you’re peeking into stocks or catching a debut film, understanding the charm and structure behind Vici Stock could very well transform your investment portfolio. And who knows? With a little bit of luck (or maybe some insightful decisions), you might find your own jackpot in the intricate dance of the market. So, keep your eyes peeled for opportunities, folks—there’s a lot coming your way!