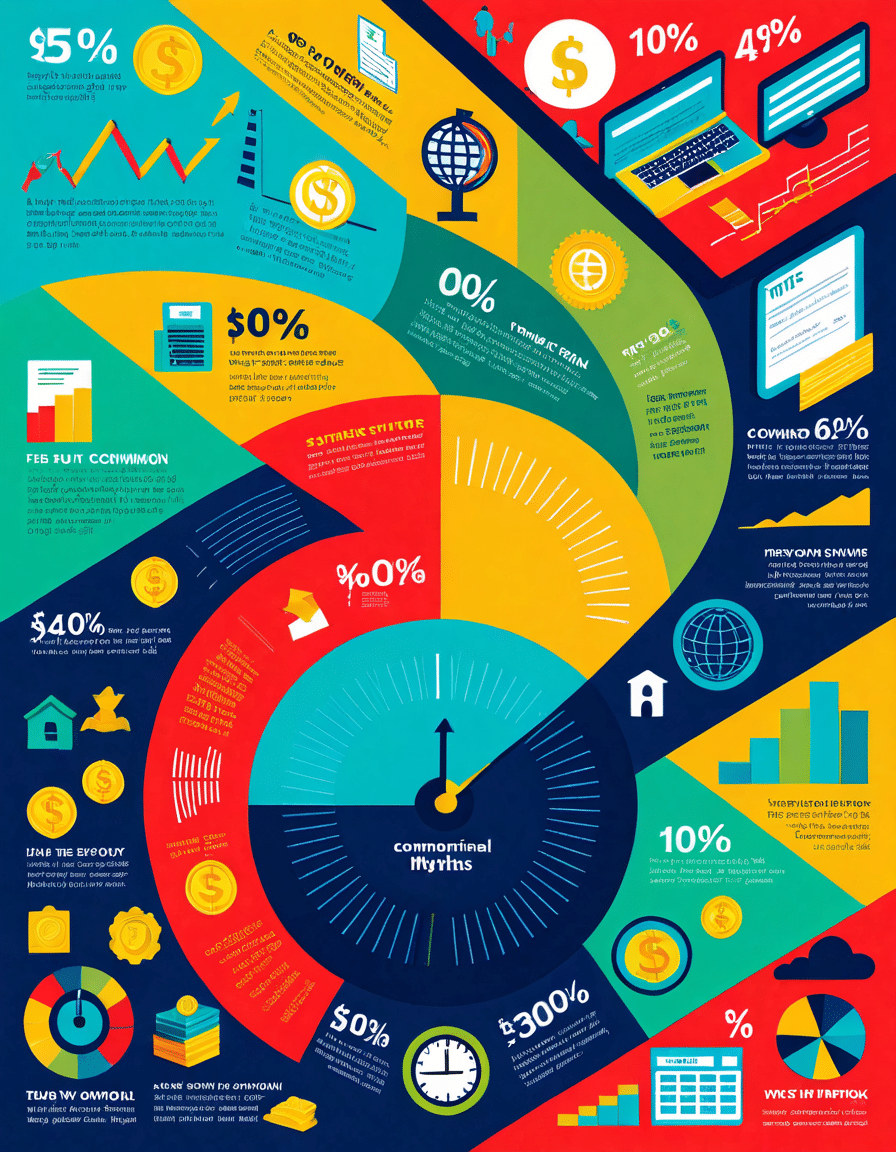

The latest taxation in the United States news is making waves in 2024, prompting countless individuals and businesses to reassess their financial strategies. To cope with the ongoing challenges of pandemic recovery and the persistent issue of wealth inequality, the U.S. government has rolled out significant tax reforms. Notably, the corporate tax rate has shot up from 21% to 25%, and estate tax thresholds have been reinstated at lower levels than seen in previous years. These changes aim to bolster funding for public services, but they’ve stirred anxiety among business owners and affluent individuals who now have to rethink their financial plans.

The ripple effects of these changes aren’t just limited to high earners and corporations. The adjustments will likely influence investment strategies, especially among larger corporations like Amazon and Google. With upward pressure on their effective tax rates, these companies will adapt their financial approaches, which can, in turn, affect stock prices and overall market stability. As these corporations jostle to maintain profitability, their strategies will dictate how well they can weather this fiscal storm.

It’s essential to delve deeper into these modifications and grasp their full implications. For instance, while the rise in corporate taxation may generate crucial funding for infrastructure and healthcare, its effect on job creation and economic growth could yield unexpected consequences. With the financial landscape shifting beneath our feet, it’s more important than ever to stay informed about changes in tax laws and how they could impact your financial future.

Top 5 Changes in Tax Deductions: Who Benefits?

As taxation in the United States news unfolds, evaluating the shifts in tax deductions is crucial for understanding who stands to gain or lose. Here’s a breakdown of the top five changes that can have significant implications for various demographics:

These changes in tax deductions aren’t just numbers on a page; they hold real-world implications for many Americans. Understanding the landscape and how it directly affects daily finances can lead to better financial planning.

Intersection of Taxation and Student Loans in the United States News

The intertwining of taxation in the United States news and student loans has generated an evolving climate for borrowers. Alongside tweaks to tax benefits for interest on student loans, major changes in repayment plans and forgiveness options are emerging. The Biden administration has introduced an updated income-driven repayment plan that seeks to reduce the burden on those grappling with substantial student debt.

By adjusting income percentages required for repayment and extending forgiveness timelines, many graduates now have a clearer path toward financial freedom. Especially for graduates from high-cost institutions such as Harvard and Stanford, options that promise lower payments and potential forgiveness after 20 years stand to make a significant impact. This transition doesn’t just alleviate debt burdens—it also reshapes borrowers’ tax liabilities and disposable income positively.

For borrowers, it’s essential to understand the intersection of these policies with broader economic trends. As student loans become a more significant aspect of financial planning, the ability to manage them effectively amid shifting tax laws is paramount. With the landscape expanding, tapping into available resources becomes critical to maximizing financial growth and stability.

The Economic Ripple Effect: Business and Personal Finance

The taxation in the United States news has broader economic ramifications that stretch from corporations to personal finance. With corporate tax rates on the rise, many companies are reconfiguring their financial strategies. Manufacturing firms, in particular, are considering relocating to states with more advantageous tax incentives, like Texas and Florida.

In light of these fiscal changes, experts anticipate shifts in personal finance strategies, including retirement planning and investment portfolios. Notably, financial institutions like Vanguard and Fidelity have begun adjusting their advisory services to accommodate these new realities. As clients navigate these turbulent waters, financial advisors must offer tailored guidance to ensure they remain on solid ground amidst constant change.

Moreover, the economic ripple effect also extends to consumer spending. With rising corporate taxes, families may find their discretionary income squeezed, compelling them to reassess their expenditures. As news of tax reforms settles in, households might shift their spending habits, consciously adapting to the evolving financial landscape.

Stakeholder Reactions and Predictions for Future Legislation

Various stakeholders have been vocal in response to the recent shifts in tax legislation. Taxpayers, financial experts, and advocacy groups bring diverse perspectives on the newly crafted tax structures. Nonprofit organizations like the Center on Budget and Policy Priorities advocate that a heavier tax burden on the wealthy can foster a fairer taxation system, while the National Federation of Independent Business raises alarms over potential growth obstacles for small businesses.

Amid these discussions, predictions point towards ongoing reforms, as the public expresses a consistent need for enhanced funding for education and healthcare. Future alterations to tax policy seem inevitable, and their influence will drastically affect how individuals and families manage their finances in times of uncertainty.

As the debate surrounding taxation rumbles on, it’s crucial to remember that understanding these implications today can pave the way for better financial health tomorrow. Amidst the shifting landscape, informed decision-making remains key to resilience and progress.

Navigating the complex shifts in taxation in the United States news is imperative for both business strategy and personal finance. By staying informed about the latest legislative developments, understanding the nuances of deductions, and anticipating potential ramifications surrounding student loans, individuals and organizations alike can set themselves up for success. As the economic environment continues to transform, proactive financial strategies can ensure stability and growth in a world that’s anything but predictable.

Taxation in the United States News Shakes Up Financial Landscape

A Quick Look at Tax Trends

Did you know that the American tax code is arguably one of the longest in the world? With thousands of pages, it can feel as complicated as sorting out the latest Barca Vs Bayern matchup! Yet, every year, updates in taxation in the United States news seem to catch many people off guard, just like a surprise buzzer-beater in NBA games, like the Nuggets vs Knicks showdown. With new policies on the horizon, taxpayers are tweaking their approaches, hoping to dodge potential pitfalls in their finances.

For instance, one surprising development in the realm of taxation is how various states are stepping up to impose their own tax policies. These changes, sometimes as unpredictable as the performance of Benzo Buddies in therapy, can shift financial strategies overnight. Interestingly, jurisdictions are not just adjusting their income tax rates; they’re also honing in on new forms of taxation, causing shifts in how we view our everyday expenses. It’s almost as if the tax landscape is changing quicker than trends in pop culture—just remember the impact of popular shows like Scrubs TV Show on society!

How Taxation Affects Daily Life

Beyond the tax changes for individuals, businesses are feeling the pinch, too. Small businesses, in particular, are adapting to these new laws and regulations. Taxation in the United States news often highlights how some businesses harness creative strategies to thrive amidst changes. It’s similar to how Sunny Sandler has navigated her career, proving that innovation can arise from constraint. While some business owners may feel overwhelmed, many are seizing opportunities to rethink how they handle their taxes, reflecting on their future like a savvy investor looking for the world’s best cat litter—a seemingly mundane choice that ends up making all the difference.

Moreover, discussions around taxation aren’t just dry numbers; they’re deeply linked with social issues, reflecting our society’s values and priorities. To illustrate, towns near Finger Lakes hotels are often involved in heated debates over local taxes—how money is spent on infrastructures, such as schools and parks. It’s intriguing how what we pay in taxes shapes our very communities, resonating through every facet of our lives, much like the confidence Chase Oliver embodies in his own journey.

So, as you digest the latest taxation in the United States news, keep an eye on these changing trends. Whether it’s personal finances, business predictions, or community investments, these updates are bound to impact us all. It’s kind of a wild ride, akin to booking a plane ticket on a Boeing 757 that takes you somewhere fun and unexpected!