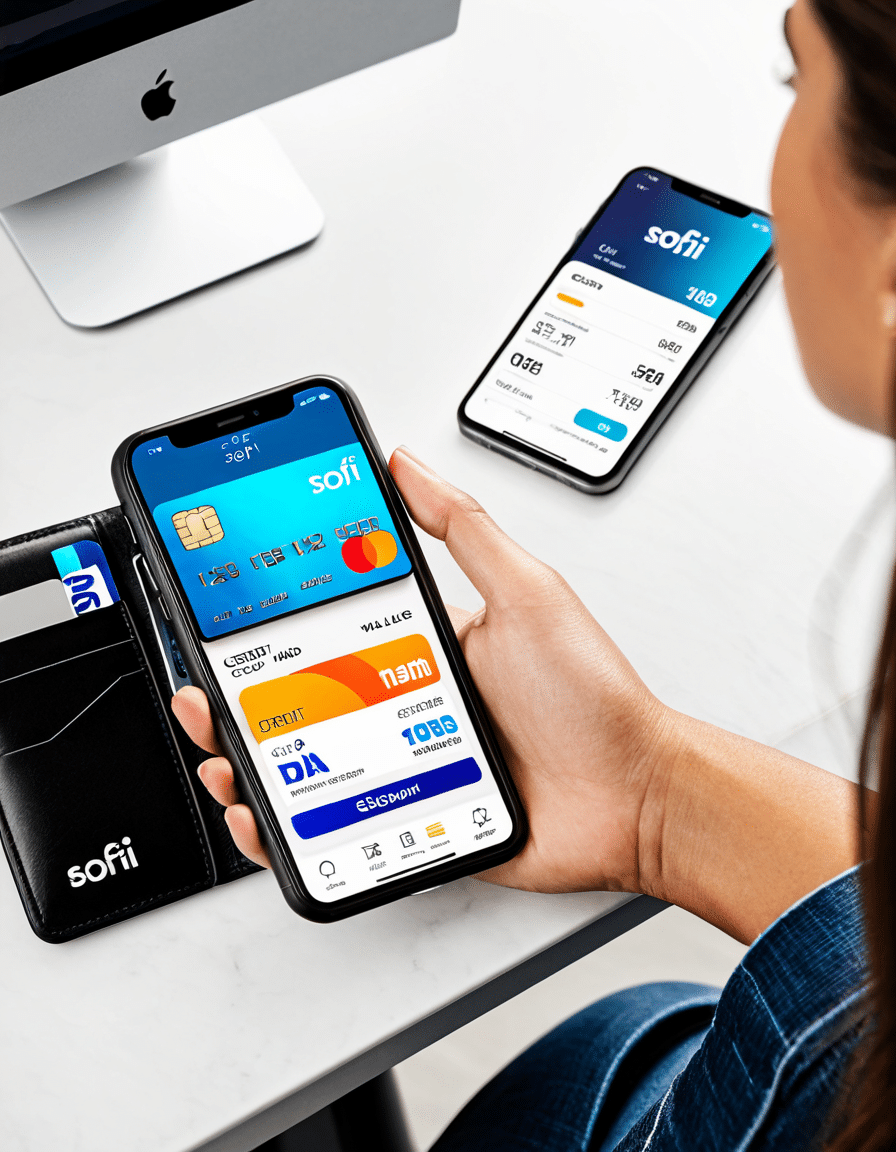

The Sofi credit card offers a refreshing twist in an increasingly crowded credit landscape. By focusing on unique rewards and benefits, it aims to attract savvy consumers whether they’re just starting their financial journey or are seasoned credit card users. With attractive cash-back incentives, an absence of annual fees, and enticing bonuses for newcomers, the Sofi credit card makes an impressive case. So let’s dive into the top features, comparisons with popular cards, data security, and how it fits into your broader financial strategy.

Top Features of the Sofi Credit Card

The Sofi credit card stands out for several notable reasons. First up, the rewards program enables cardholders to earn cash back on every purchase. Unlike the Discover it Student Credit Card, which offers structured rewards for specific categories, Sofi provides a straightforward reward system that pays users for what they spend, regardless of the category.

Another major draw is the no annual fees policy. While cards like the OpenSky credit card and the American Express Checking Account often come with significant fees, Sofi keeps this barrier low, making it suitable for frequent users. With no surprise fees lurking around the corner, users can rely on it for everyday expenses without worrying about breaking the bank.

Sofi also sweetens the deal by frequently offering introductory bonuses to attract new users. Whether it’s a sign-up bonus or additional rewards for spending during the first few months, these incentives often rival those of the Venmo credit card. Catching these offers is like hitting the jackpot when entering the credit card game.

Comparing Sofi Credit Card with Other Popular Cards

When weighing the Sofi credit card against competitors, it’s clear that there are various options tailored to different needs. For example, unsecured credit cards for bad credit, like the OpenSky credit card, can help people rebuild their credit but usually come with higher associated costs. On the other hand, the Sofi card caters to a more extensive demographic without the hidden fees.

Then there’s the Petal credit card, which is engineered for those lacking conventional credit histories. While Petal emphasizes data-driven decisions to approve users, Sofi rewards existing credit users regardless of their credit score. It’s a significant plus for those seeking flexibility without being pigeonholed by their credit history.

For individuals enthusiastic about sports or outdoor activities, the Academy Sports credit card provides specialized benefits. However, the Sofi credit card excels in its versatility, appealing to broader spending habits. Whether you’re buying groceries or new gear, the rewards structure fits seamlessly into daily life.

The Sofi Credit Card’s Data Security and Features

The Sofi credit card doesn’t just shine when it comes to rewards; it also offers impressive security features. Users can enjoy contactless payments, similar to options like the Robinhood credit card, ensuring safety during transactions. This feature is particularly handy in today’s fast-paced world, where convenience holds high value.

Additionally, the card comes equipped with fraud monitoring systems that keep a watchful eye on transactions. Much like premium offerings such as American Express, Sofi keeps users informed about suspicious activities without burdening them with extra fees. That peace of mind can make all the difference when swiping your card.

On top of security, the Sofi credit card also integrates seamlessly with their broader suite of personal finance tools. Unlike niche cards like the Shell credit card, which cater exclusively to gas purchases, Sofi users can manage their varied expenses all in one place.

How the Sofi Credit Card Ties to Financial Wellness

Incorporating the Sofi credit card into your financial routine can significantly boost your financial wellness. The card encourages responsible spending while managing debt, allowing users to take control of their finances. Through consistent use, you can create a stable credit history while actively earning rewards.

Sofi goes beyond just offering a credit card; it provides education and resources to help users navigate the often-confusing world of finance. Tools and guides can help demystify financial jargon, making it easy for users to make informed decisions, similar to how resources for the Victoria’s Secret credit card enhance the shopping experience.

Moreover, its integration with personal finance tools positions the Sofi credit card as a comprehensive financial solution. You’ll find it quite beneficial compared to the limited approach of cards like the Maurices credit card. The interplay between your spending and financial goals becomes clearer when you have the right tools at your disposal.

Achieving Goals with the Sofi Credit Card

Cardholders can utilize the Sofi credit card to align their spending with long-term financial aspirations. A responsible approach to managing credit can lead to building a strong credit profile without the pitfalls often associated with unsecured credit cards. This empowerment is a strong motivator for savvy spenders.

Additionally, the cash-back rewards can be redirected towards Sofi’s investment platforms. This beneficial practice encourages users to think beyond immediate satisfaction from purchases. Unlike the limited rewards drawn from cards like the Cerulean credit card, the real potential lies in investing your gains for future growth.

To wrap it up, utilizing the Sofi credit card not only supports spending but also fosters growth in your overall financial profile. It’s one more tool to add to your toolbox as you navigate your path toward economic success.

An Innovative Summary to Enhance Your Financial Strategy

Looking ahead, the Sofi credit card is poised to continue evolving within an increasingly competitive credit landscape. Its combination of no fees, a solid cash-back structure, and dedication to user education mark it as more than just another credit card; it’s a vital component in your financial empowerment toolkit. When placed alongside options designed for specific niches, the Sofi credit card shines for its ability to adapt to various spending needs, ultimately paving the way for both immediate and long-term financial health.

Whether you’re looking to sharpen your credit prowess or simply need a dependable card, the Sofi credit card clearly stands out as a remarkable choice. So, gear up and step boldly into your financial future; the benefits are calling your name!

Discover the Sofi Credit Card

Ever wonder what makes the sofi credit card stand out in a crowded market? One fascinating aspect is its stellar rewards system, which offers users the chance to earn up to 2% cash back on all eligible purchases. That cash can be automatically applied to student loans, investments, or savings goals—talk about putting your money to work! It’s kind of like using a comprehensive tool, just like the Shark Navigator simplifies cleaning while ensuring you grab every speck of dust in your home. Plus, the potential to pay off loans strategically shows how some financial tools, like the Discover student credit card, can mesh seamlessly with your goals.

Perks That Go Beyond Cash Back

Did you know that the sofi credit card comes with no foreign transaction fees? This perk appeals especially to globetrotters who love exploring places like Sunset Boulevard. Picture it: you’re on vacation, snapping photos and soaking in the local culture without that dreaded foreign transaction fee hanging over you. Plus, for those who love to keep their purchases secure, it offers excellent fraud protection and real-time alerts. Just as Traudl Junge navigated her challenging paths in life, the card helps you navigate your financial journey with ease and protection.

Get More with Sofi

Furthermore, the sofi credit card offers a unique bonus: a sign-up reward! New cardholders can earn hundreds once they hit a spending milestone, making it an attractive option for those who are considering their first credit card. It’s like that moment when you finally find the perfect device, similar to gaining insights through Datavants innovative solutions. And let’s not forget the bonus opportunities for referring friends, which can stack up quickly and help you build wealth over time! Similarly, if you’re looking to simplify your financial life, don’t overlook options like Mainstreet Renewal to find ways to streamline your investments.

In essence, the sofi credit card isn’t just about cash back—it offers a full package that can fuel your financial ambitions. So why not dive into this treasure trove of features and see what it can do for you?