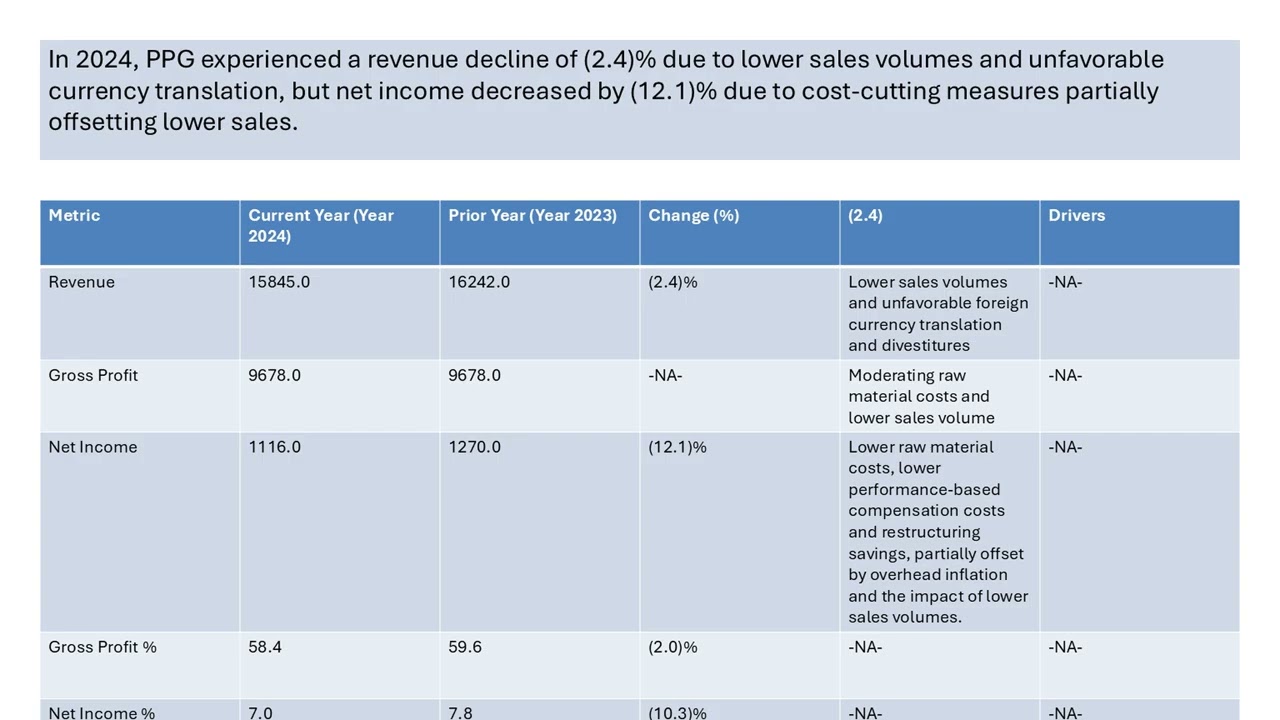

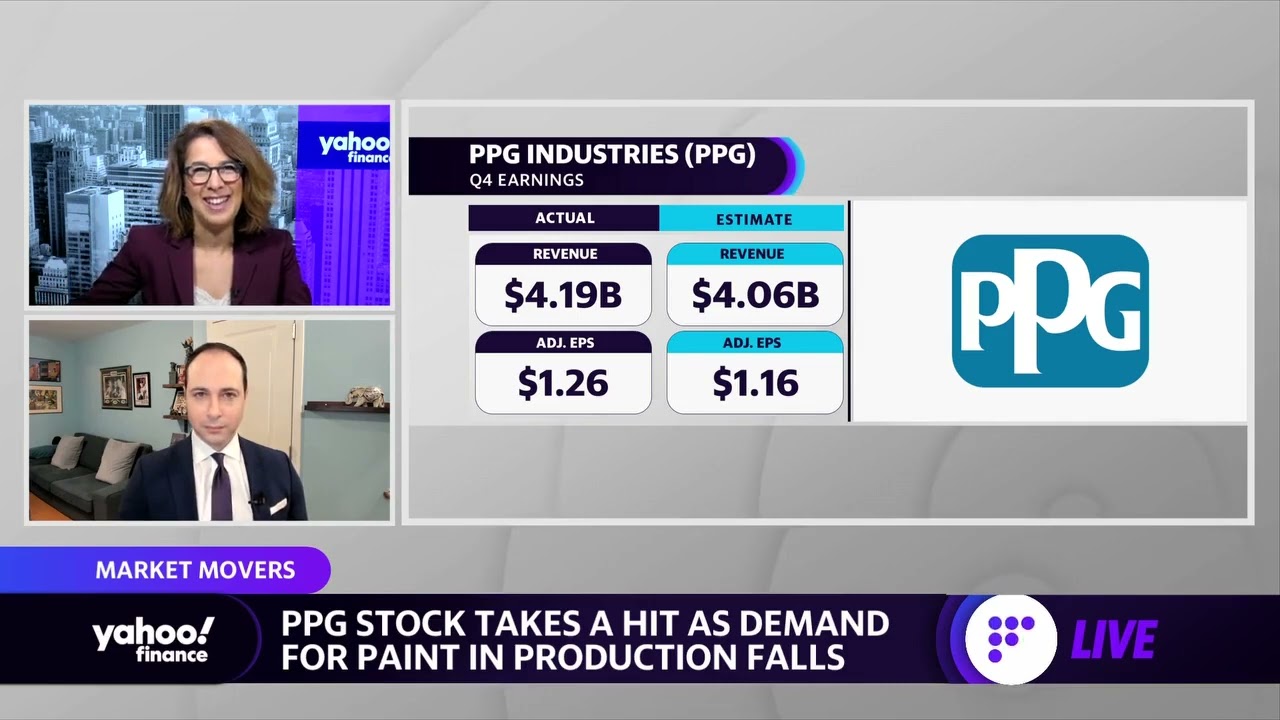

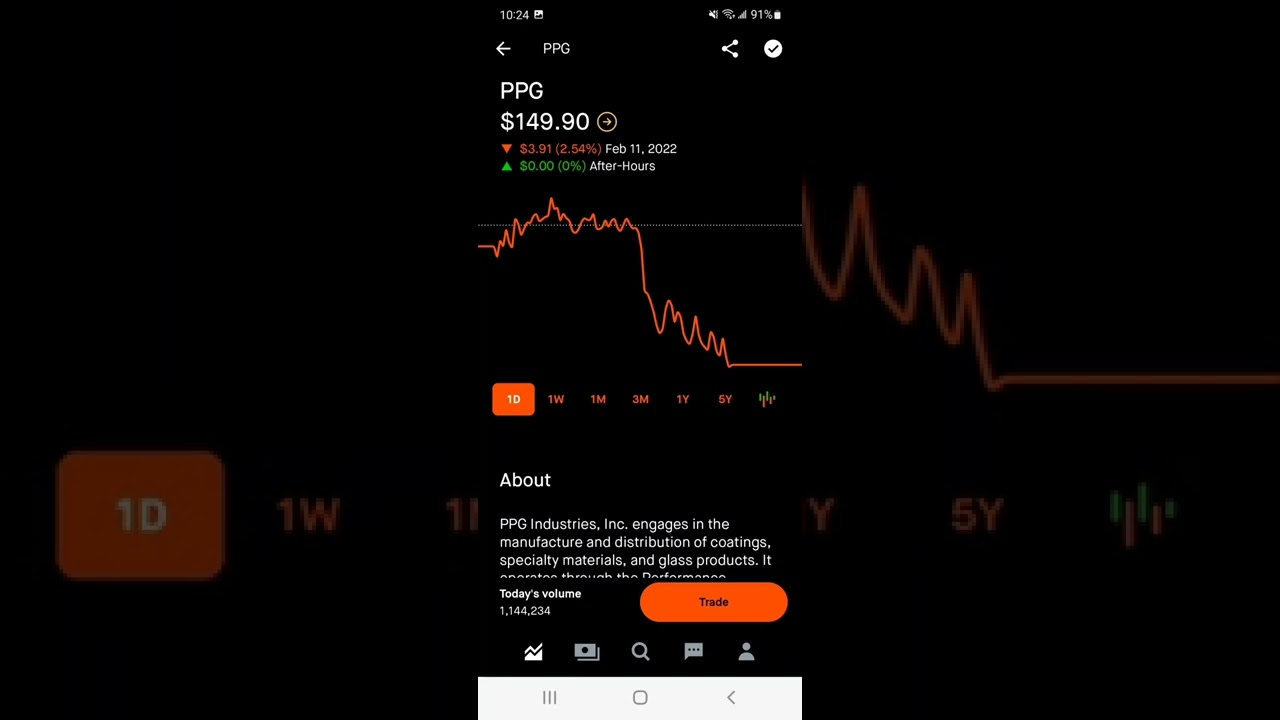

In the fast-paced world of stock trading, PPG stock (NYSE: PPG) is making waves in 2026. The remarkable surge in its stock price, driven by strong buy ratings and major deals, has grabbed the attention of investors. Analysts have shifted their perspective, viewing PPG Industries as a lucrative opportunity. With a consensus rating of Moderate Buy, supported by 7 buy ratings and 10 hold ratings, the buzz surrounding PPG stock has never been louder. The average price target sits at a healthy $128.13 according to 17 of Wall Street’s finest analysts. So, what’s behind this excitement? Let’s delve deeper into the key factors that are propelling PPG stock higher.

1. The Driving Factors Behind PPG Stock’s Surge in 2026

PPG’s surge can be attributed to pivotal developments in its strategic partnerships and market positioning. The aerospace and automotive sectors, in particular, have opened new doors for PPG, enhancing both revenue and investor confidence. Recent deals have not only increased PPG’s market share but have also solidified its reputation as a leader in coatings and specialty materials.

One driving factor includes the general rebound in construction activity, which has a domino effect on construction-related materials, including paints and coatings. As buildings and infrastructure projects ramp up, demand for quality products from companies like PPG continues to grow. Furthermore, improvements in vehicle production rates are contributing to the soaring sentiment around PPG stock. The combination of these trends makes for a powerful narrative that keeps investor interest piqued.

Moreover, with the company’s recent decision to sell its architectural coatings business in the U.S. and Canada to American Industrial Partners for $550 million, PPG is streamlining its focus and shedding less profitable segments. This move allows the company to concentrate on critical sectors like aerospace and automotive, ensuring that resources are efficiently allocated to high-growth areas.

2. Top 5 Major Deals Fueling PPG Stock’s Growth

PPG stock owes a significant part of its growth to several key deals that have been quantified in dollars and impact. Here are the top five partnerships that have set PPG on its rich path in 2026:

3. Comparative Analysis: PPG Stock Versus Other Industry Players

To gauge how well PPG stock is doing, it’s worthwhile to see how it stacks against its competitors like APLS stock (Apellis Pharmaceuticals), CHRS stock (Coherus BioSciences), AON stock (Aon plc), and MTB stock (M&T Bank). Each of these stocks offers a unique narrative in 2026.

4. Investor Sentiment and PPG Stock Projections

The prevailing investor sentiment around PPG stock remains exceedingly optimistic. Analysts are forecasting ongoing growth for the company, fueled by robust economic indicators such as a recovering construction industry and increased vehicle production rates. The general bullish outlook defines PPG stock as a prime candidate for investment.

Investors care deeply about the future, and PPG’s recent shifts to streamline operations hint at a company that understands the pulse of the market. Numerous investors are taking note of how PPG stock aligns with broader economic trends that indicate promise. With all signs pointing toward expansion, PPG is poised to fulfill shareholder expectations.

5. The Broader Market Context: Stock Dynamics Among Peers

When we look at the broader market context, comparing stocks such as TSLY stock (Tesla Stock ETF), GCT stock (Global X Telemedicine ETF), and ESPR stock (Esperion Therapeutics) reveals how external pressures influence stock performance. TSLY thrives on technological advancements, showcasing significant appetite for innovative stocks, while GCT captures attention for its telehealth innovations.

Contrasting these with PPG, whose trajectory is grounded in industrial success rather than tech hype, helps solidify its investment rationale. PPG remains a robust player amid competitive market conditions, showing that being rooted in industry pays dividends. Investors must take these differences into account when assessing the evolving landscape.

6. The Impact of Emerging Stocks: Opportunities and Risks

Emerging stocks such as HKD (AMTD Digital Inc.) and EBS (Emergent BioSolutions) can inject unpredictability into the market. As these newcomers attract attention, they might siphon some investor focus away from established performers like PPG stock. While on the one hand, these emerging opportunities can be enticing, they also carry risks.

Investors need to tread carefully. Stocks like HKD and EBS can be appealing due to their growth potential, but with potential rewards come risks. Exploring the intricacies of these emerging companies allows for more informed investment strategies surrounding PPG stock.

Wrap-Up: The Future of PPG Stock and Market Dynamics

As PPG stock rises, it stands on the cusp of continued potential, buoyed by strong demand and strategic partnerships. Excellent positioning in key markets enables PPG to gain a competitive edge. While its journey is promising, invest wisely—monitor market data and emerging trends to navigate changes effectively.

In conclusion, PPG stock showcases the blend of robust fundamentals and strategic growth, ensuring it’s a staple for investors keen on the dynamics of 2026. The time is ripe for those looking to harness the momentum of strong ratings and impressive deals, so keep your eyes peeled on this one!

PPG Stock: A Surge Fueled by Strong Buy Ratings and Major Deals

The Buzz Behind PPG Stock

PPG stock has been making headlines lately, with strong buy ratings and major deals setting off an impressive surge. But did you know that PPG is part of a larger tapestry of interesting companies that have made waves in their sectors? For instance, while you might be busy tracking your PPG investments, you could take a moment to explore the captivating characteristics of the high fin tetra fish, which are known for their vibrant patterns and unique swimming styles. Just like this fish, PPG stock showcases some remarkable agility in the market.

Protective Waves and Market Moves

As PPG continues to solidify its place in the coatings industry with strategic partnerships, it’s fascinating to look at how diversified investments can spread out risk. Speaking of diversification, if you’ve ever thought about fashion, the Skims bras line has significantly changed how people view comfort and style, just as PPG changes the landscape of protective coatings. With a keen insider’s eye, discovering what factors drive Vici stock or observing the storytelling prowess of authors like Karin Slaughter can add further dimensions to your investment strategy, mixing creativity with market analysis.

Navigating Opportunities

What about those who are looking into investment avenues beyond the conventional? For example, if you’re considering the latest trends in collectibles, check out how Bettinardi is reshaping the golfing community with its innovative putter designs. PPG stock is all about understanding the market’s subtle shifts, such as the rising demand for sustainable products, which could be key in maximizing returns. And let’s not forget to keep an eye on PPL stock, as it’s another player in the utility sector that complements PPG’s opportunities in business expansion.

In a nutshell, jumping into the market can be reminiscent of finding the perfect Chloe bag: it often requires patience and an eye for quality. Remember, whether you’re delving into the mechanics of NMLS or even mingling with celebrity worlds like Shannon De Lima, there’s always room to learn new tricks that can enhance your fiscal journey. Keep watching PPG stock; the best may yet be ahead!