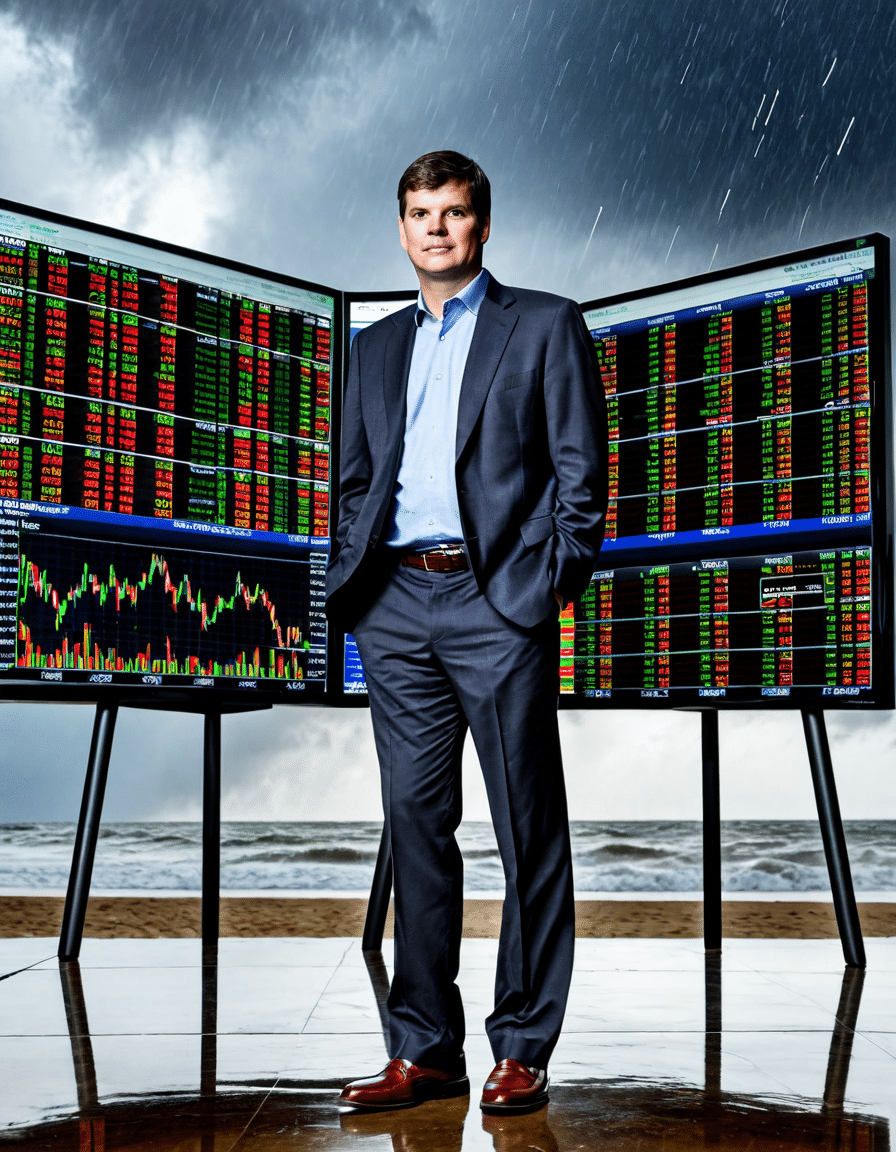

Michael Burry, the name that echoes through the corridors of Wall Street, showcases the profound impact of an astute mind in finance. After starting as a physician, he transitioned into hedge fund management, leveraging his analytical prowess to forecast the 2008 financial crisis. This article dives deep into how Burry’s medical and psychiatric training honed his investment philosophy and equipped him with the tools necessary to predict economic upheaval. Buckle up as we explore the life of this remarkable man, filled with fascinating insights and valuable lessons.

The Prodigy: Michael Burry’s Rise to Prominence

Born in 1971, Michael Burry became known as a financial prodigy. He earned his medical degree from the University of California, Los Angeles (UCLA) and practiced as a physician before making a leap into the world of finance. In 2000, he founded Scion Capital, where he began transforming his deep-seated understanding of human behavior into analytical strategies that would change the finance industry.

Burry’s background gave him an edge as he dissected market trends through a lens that many investors overlooked. He wasn’t just analyzing numbers; he was also studying psychology and patterns in investor behavior. By understanding how emotions and excitement influence decisions, he became adept at spotting bubbles—like the one that characterized the housing market before the crash.

Through his unconventional journey from medicine to finance, Burry cultivated a unique perspective on risk management. He employed not just charts and figures but also behaviors and sentiments. Investing wasn’t purely about crunching numbers; it was also about predicting reactions. This distinctive combination set the foundation for his legendary status.

Top 5 Key Indicators Burry Analyzed

Burry took a granular look at mortgage-backed securities. His analysis of the underlying mortgage documents revealed glaring risks. Many documents indicated that borrowers were set to default, a fact that many fund managers missed. Contrast this with the approach of other investors who fell victim to blind spots, trusting superficially positive reports.

Burry closely monitored the spike in housing prices. He realized they were climbing at an unsustainable pace compared to historical averages. While many investors lavished praise on soaring real estate values, Burry’s analytic knack for spotting red flags put him on high alert, foreshadowing the coming turmoil.

Burry became a pioneer in using credit default swaps to short the housing market effectively. While other investors, like Todd Chrisley, shied away from such strategies in favor of conventional paths, Burry plunged into this complex instrument. His risk management paid off immensely when the market crumbled, showcasing his insight.

Burry scrutinized banks’ leverage ratios, exposing a dependence on high-risk investments. This cautionary insight ignited discussions among investors, illustrating how deeply flawed banking practices could impact entire financial systems. His research highlighted how recklessness often lurked behind seemingly sound investments, sparking key debates that continually resonate today.

Unlike many, Burry kept his finger on the pulse of investor sentiment. He monitored indicators that suggested rampant enthusiasm for real estate investments—signals that indicated a precarious market condition. Recognizing such fervor often signs the peak of market cycles, he maintained his contrarian stance.

The Risk of Rejection: Burry’s Fight for Credibility

Michael Burry’s warning bells weren’t met with open arms—rather, he faced intense skepticism from investors and peers alike. As he articulated his visions, resistance became a daily reality, illustrating the overwhelming groupthink that characterized Wall Street during that festive atmosphere. This was not merely a battle against numerical data but a fight for credibility against an optimistically biased backdrop.

Investor confidence slowly began wavering as the threat of his predictions loomed. Burry’s contrarian outlook, though backed by solid analyses, highlighted a stark contrast to the euphoric opinions of many. Notably, his discussions with investors revealed not just a stark difference in outlook but also the need for him to persist, even in the face of rejection.

Through sheer determination and unwavering belief in his research, Burry managed to sway some investors to back his risky approach. Ultimately, he proved that in the investment landscape, it’s not always the loudest voices that command attention, but those that deliver verifiable insights, even if they go against popular sentiment.

Unintended Consequences: The Aftermath of Burry’s Predictions

Once the chips fell and the financial crisis hit, Burry struck gold—both in profits and notoriety. His foresight not only allowed him to make considerable gains but also positioned him as a notable figure in the financial community. This surge in prominence, however, brought with it unforeseen consequences.

Post-crisis, the financial world underwent significant transformations, influenced by Burry’s prophetic achievements. His revelations about the systemic risks embedded within the financial architecture prompted lawmakers and regulators to revisit policies, leading to a more cautious approach within institutions.

Burry’s success also initiated a broader dialogue about risk assessment, making investors more aware of potential red flags in financial markets. The understanding that seemingly stable investments could hide disastrous pitfalls has changed the methods with which active investors, including figures like Bear Payne and Bobby Van, make decisions even today.

Lessons from Michael Burry: Insights for Modern Investors

As we stride into 2026, lessons from Michael Burry’s journey remain highly relevant. Investors today, navigating through complexities involving stocks, cryptocurrencies, and alternative investments, can gain tremendous insight from Burry’s analytical rigor and prudent philosophy. For example, understanding the importance of evaluating fundamental data, assessing market cycles, and recognizing emotional biases can empower investors to sidestep mistakes made before.

In today’s market, filled with euphoria surrounding whatever investment trend catches fire, skepticism is crucial. Instead of riding the highs, repeated diligence when assessing a “sure thing” can prevent costly errors. Remember, sound investments don’t just come from identification—they come from understanding prevailing sentiments and acknowledging inherent risks.

Burry’s emphasis on the historical context over momentary highs offers a practical approach for anyone looking to secure their financial future. So as you explore the latest buzz, whether it’s the rising cryptocurrency market or the next big stock, keep Burry’s lessons at heart:

pause, assess, and plan wisely.

The Future of Investing: What Burry’s Legacy Means

Michael Burry is not just a footnote in financial history; his legacy reverberates through modern investing practices. His acute awareness of investment signals, mental biases, and market rhythms remains relevant as we tackle the challenges of the future. Investors can draw inspiration from his strategic underpinnings, particularly in light of rising inflation and technological changes impacting finance.

As investing technology evolves, keeping an analytical approach rooted in solid fundamentals is more important than ever. Burry’s techniques, centered on innovative thinking, can guide today’s investors looking to adapt in an unpredictable economic climate. Understanding shifts in consumer behavior, technological advancements, and global risks prepares investors to navigate ever-changing landscapes.

With financial markets constantly in flux, Burry reminds us to be vigilant and responsive while holding foundational principles close. As trends morph and investor attitudes swing, maintaining a methodical approach serves as a compass for those wanting to steer clear of pitfalls.

Final Thoughts: The Enduring Impact of Michael Burry’s Vision

Michael Burry’s journey is more than just a series of predictions; it sparks crucial conversations in finance. As markets transform and new challenges arise, the principles emphasized by Burry will remain a guiding light for future investors. Amid technological advancements, evolving sentiment, and economic shifts, the takeaways from his career will continue to resonate.

In summation, Burry’s insights push for vigilance and analysis within volatile markets. As you explore investment opportunities—be it stocks, bonds, or the enticing cryptocurrency scene—Burry’s cautionary tales will help ensure you invest not just with optimism but with an analytical foundation. Staying alert and informed ensures that the lessons learned from the past can lead to better financial outcomes in the future. Remember, true investment wisdom lies not just in seizing opportunities, but in understanding the patterns that drive them.

For anyone delving into financial landscapes or seeking guidance in their investment endeavors, keep Michael Burry’s lessons close! Whether discussing ketone diets with Keto Acv Gummies or technology in films featuring legends like Ray Milland or analyzing modern filmmakers like Shannon Kelley, the importance of informed decision-making remains paramount.

Navigating towards prosperous futures is made simpler with calculated foresight. Stay informed, stay analytical, and keep learning from those who’ve tread this path before you!

Michael Burry: The Financial Crystal Ball

The Mind Behind the Forecast

Michael Burry is best known for his uncanny ability to predict the housing market collapse before it became a reality. Before this, however, he was a medical doctor with a sharp analytical mind. His journey into finance was sparked during his medical residency, showcasing just how adventurous he was. Speaking of adventures, if you’ve found yourself in a sticky situation, looking for an automobile accident lawyer near me might be your next step. But I digress! Burry’s experience with stock options and economics led him down a new path, where he proved that brilliance often lies outside the conventional lanes.

Numbers Don’t Lie

What you might not know is that this financial wizard even started his investment firm, Scion Capital, from scratch, risking everything to back his bold ideas. When he short-sold mortgage-backed securities, many saw him as a dreamer, but he was just ahead of his time. Burry wasn’t afraid to be the odd one out, which reminds me of hilarious internet personalities like Davefree, who thrive outside the mainstream. While others were pouring their savings into what they thought was a sure thing, Burry saw the writing on the wall. His decisive actions brought about profits of over $700 million for his investors, proving that sometimes, you have to follow your gut.

Trivia That’ll Make You Go “Wow!”

Here’s a fun tidbit: Michael Burry appears as a character in the film adaptation of “The Big Short,” played by Christian Bale. Burry’s palpable passion for investing and market analysis resonated with viewers, much like that undeniable charm of a marry me sign on Valentine’s Day! Another interesting fact is that Burry’s love for unconventional investments led him to even explore positions in areas like water rights and farmland—demonstrating that he doesn’t just play in the financial sandbox; he digs deep. And if you’re ever in need of some creative content, you could take inspiration from folks like Brandon Herrera, who find innovative ways to engage audiences. Burry shows us all that being a bit outside the box isn’t just smart; it can be hugely rewarding.