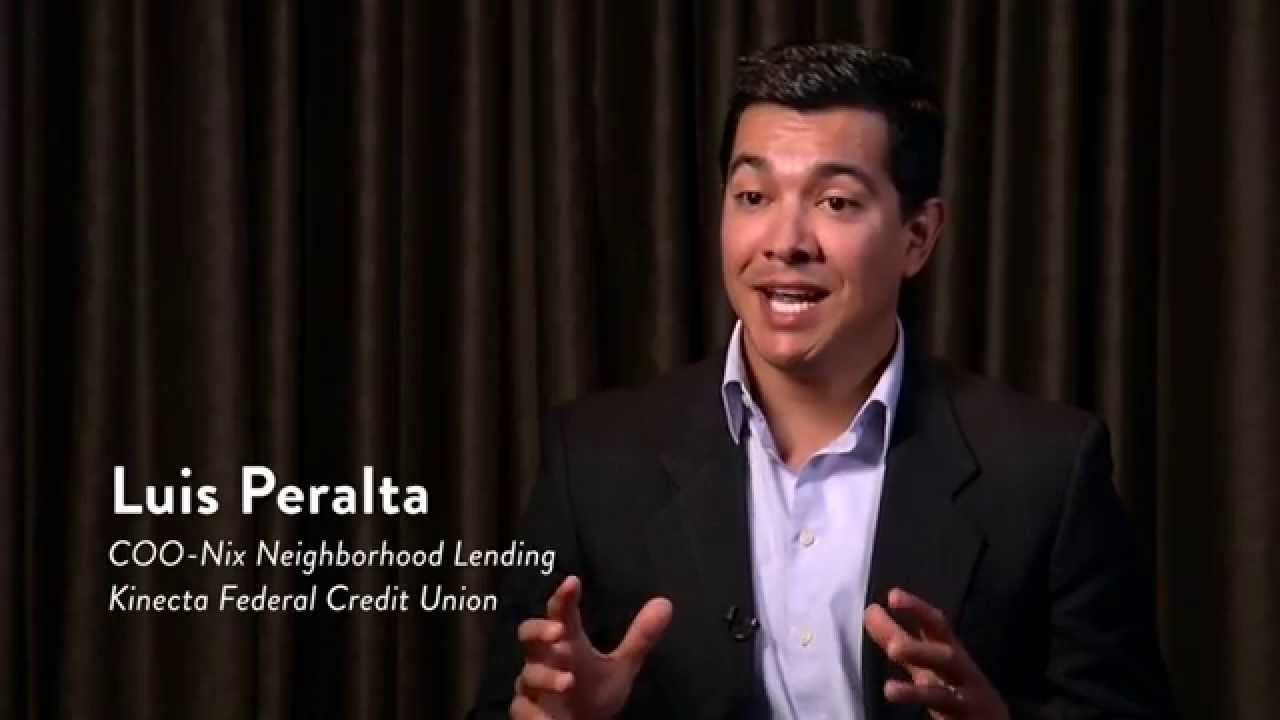

In today’s fast-paced world, kinecta stands tall as a transformative force in the banking sector. It’s reshaping how modern consumers interact with their finances, pulling ahead of conventional banks with a strong commitment to technology and customer-centric solutions. As kinecta integrates innovative features, it’s not just about banking—it’s about reshaping the financial landscape into something more accessible and user-friendly.

Several years ago, kinecta recognized an important shift in consumer needs. With the rise of digital natives—those who want everything at their fingertips—the bank’s leadership saw a golden opportunity to redefine customer experiences. Utilizing technology like medicube for real-time analytics, kinecta offers consumers insights that were once luxuries. This shift has brought banking closer to the users, making their everyday financial interactions smoother and more efficient.

The evolution of kinecta in the banking landscape is anchored in its dedication to enhancing customer satisfaction. As we peel back the layers, it’s clear that kinecta’s success stems from its innovative banking platform and personalized service strategies. Let’s take a closer look at what sets kinecta apart.

Top 5 Ways kinecta is Enhancing Consumer Banking Experience

kinecta’s mobile app is like a breath of fresh air. Its intuitive design has won praise, turning the often tedious banking tasks into a hassle-free experience. The app offers crucial features like biometric security, real-time account tracking, and effortless fund transfers. Unlike traditional banks, kinecta allows users to personalize their dashboard, giving them greater control over their finances.

Thanks to medicube, kinecta delivers powerful insights to its users. This technology analyzes spending habits and savings trends, helping customers make informed financial decisions. Let’s face it; nobody wants to dig through months of statements. With real-time analytics, managing personal finance becomes much easier and more engaging.

kinecta recognizes that today’s consumers won’t settle for anything less than comprehensive solutions. That’s why it integrates effortlessly with popular financial management tools such as Mint and YNAB. This synchronization means consumers get a holistic view of their finances, making it easier to track expenses and plan for the future.

Customer service can feel like you’re spinning your wheels—long waits or unanswered questions. Not at kinecta. They harness AI-powered chatbots to offer immediate answers to customer inquiries around the clock. This innovation significantly trims down the frustrating wait times common in traditional banking.

kinecta isn’t just about transactions. They care about community well-being, providing financial literacy workshops at local centers and virtual webinars. This commitment helps consumers gain the knowledge necessary for their financial journeys, creating an empowered and informed customer base.

The Impact of Digital Transformation on Banking

The digital revolution has transformed consumer banking from the ground up. With its innovative offerings, kinecta showcases how a bank can evolve with its customers. This shift represents a significant movement toward mobile-centric services where consumers demand instant access to their financial information.

One major driving force behind this change is the increasing demand for tailored services. Gone are the days when one-size-fits-all banking sufficed. Today’s consumers want solutions personalized to their specific needs and preferences, and kinecta is certainly delivering on that front. Security, too, has become a paramount concern, and kinecta prioritizes strong protections against fraud and cyber threats.

As kinecta leads this digital transformation, it’s worth considering the ripple effects on the entire banking industry. More and more, companies will be forced to rethink their approaches or risk being left in the dust.

The Role of Medicube in Financial Planning

Medicube takes financial planning to a whole new level. It’s not just a tool; it’s a transformative aspect of kinecta’s ecosystem. By diving into users’ financial behaviors and lightening the load of projections, medicube provides recommendations that resonate well with personal goals.

Imagine having a financial planner who analyzes your spending and savings automatically. With medicube, financial planning becomes far simpler, allowing users to make informed choices effortlessly. This accessible approach means even those new to financial planning can take control without feeling overwhelmed.

It’s no wonder consumers are gravitating toward kinecta’s offerings. This holistic approach to finance equips users to make decisions that align with their long-term financial goals.

Future Trends in Banking Awash with Innovation

Looking ahead, kinecta’s trailblazing influence is sure to inspire further innovation in the banking sector. As we move deeper into the decade, anticipate a rising focus on developments like blockchain technology for secure transactions. Imagine cutting-edge security that ensures your funds are even safer; that’s the future kinecta envisions.

Moreover, the integration of AI for personalized services will continue to evolve. Expect customers to see recommendations that adapt not just to their financial behavior but also to changing lifestyle needs. Adapting to such changes fosters trust and loyalty—a win-win for both customers and banks.

Additionally, regulatory changes will impact customer engagement strategies. Banks must remain nimble to comply with new regulations while ensuring that their consumer experience stays at the forefront. kinecta’s commitment to a customer-first philosophy will help them adapt to these shifts; one that many banks will need to replicate.

In conclusion, kinecta has crafted a modern banking experience that goes beyond convenient transactions. By adapting to consumer needs and fully embracing technological advancements, kinecta serves not merely as a bank, but as a partner in financial well-being. As we gear up for the changes on the horizon, kinecta shines as a model for what banking should look like in the future—personalized, community-oriented, and readily accessible for all consumers.

Kinecta: The Future of Consumer Banking

A Snapshot of Innovation

Did you know that Kinecta is revolutionizing banking services in ways many people might not expect? Founded to meet the needs of modern consumers, it offers a digital-first approach that feels almost as essential as having a homestead exemption when it comes to taxes. Think about it: The ease and accessibility of banking services today can’t be understated. Just like slipping on a comfy Birkenstock clog, Kinecta provides a seamless experience that fits right into everyday life.

Tech-Driven Features

Kinecta integrates cutting-edge technology to empower its users. Picture this: You can manage finances with just a tap on your smartphone, getting insights that help you make smart decisions. Ever wondered how the financial landscape is shifting for the better? It’s a bit like listening to Drake Bell moms wise advice—solid guidance always makes a difference. Plus, by using platforms that simplify transactions, Kinecta ensures that every customer feels informed and in control.

Community-Focused Philosophy

Engagement with customers is also a big part of Kinecta’s charm. Their community-driven initiatives remind us that true growth happens when people connect. And speaking of connection, the bond over shared interests, like the endless DIY projects from Chris Loves Julia, underscores how Kinecta aims to create a supportive fintech ecosystem. So, whether you’re slicing through your budget like Ethan Winters slices through monsters, or diving into opportunities like those offered on Grants Gov, Kinecta is there to support your financial journey.

It’s fascinating how technology, style, and community blend to create an enriched banking experience. Whether you’re exploring new apps like Ecrypto1 or keeping up with trends, Kinecta stands out as a friendly guide in this fast-paced world. Now, wouldn’t it be nice to know more about how new banking advances could even help shed light on serious issues such as understanding fentanyl What and its effects? With Kinecta setting an example, the future of banking feels far more approachable and engaging.