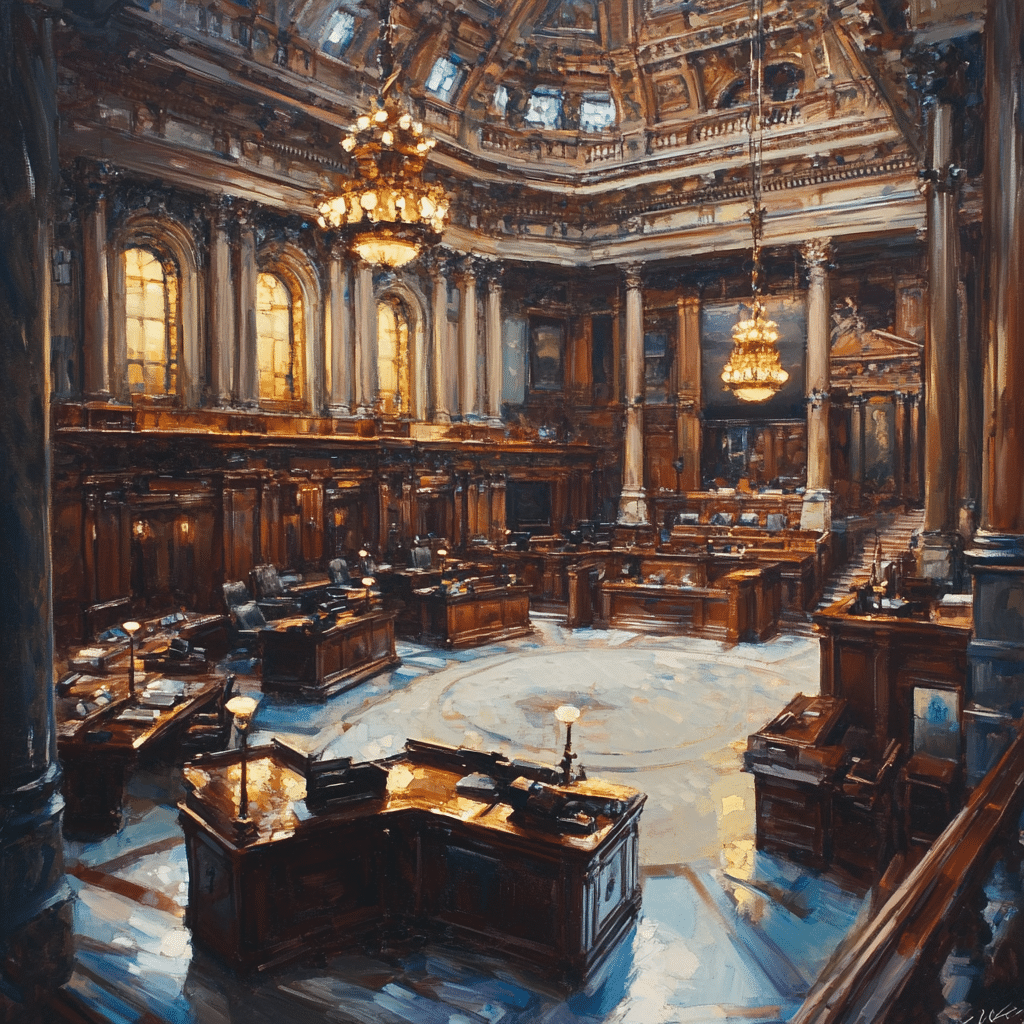

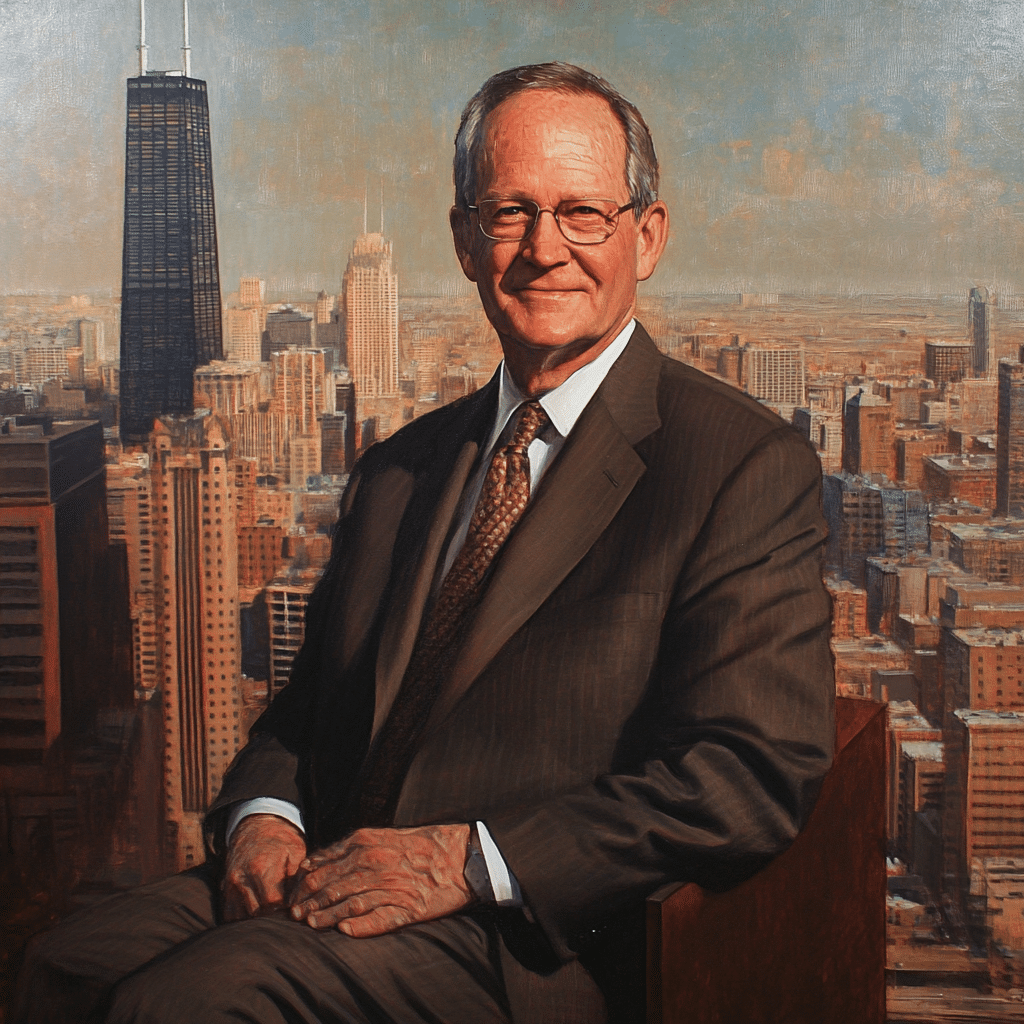

The Illinois Comptroller plays a pivotal role in steering the financial ship of this midwestern state. It’s a position that’s responsible for ensuring fiscal accountability, managing public funds, and keeping a close eye on the state’s financial health. With Susana Mendoza leading the way, her office affects several areas that impact daily life for Illinois residents. Let’s dive deeper into their responsibilities and the real-life implications of the Comptroller’s work, painting a picture of how state finances function as we hustle into 2024.

The Role of the Illinois Comptroller in Shaping State Finances

1. Overview of the Illinois Comptroller’s Responsibilities and Authority

At the heart of the Illinois Comptroller’s duties lies the responsibility for disbursing state funds. This office plays a critical part in budgeting, auditing, and providing transparency in financial operations. Their legal authority is anchored in the Illinois Compiled Statutes, which grant them the right to oversee fiscal management and enforce accountability. In essence, the Comptroller’s office is the watchdog that ensures spending aligns with state priorities.

Budgeting is not just about balancing numbers; it impacts vital social programs, education, and infrastructure development. That is why the office prioritizes transparency, making it easier for the public and lawmakers to understand state expenditures. With these tools and powers, the Illinois Comptroller shapes the financial landscape, ensuring that taxpayer dollars are utilized effectively.

2. Four Key Areas Impacted by the Illinois Comptroller’s Office

To grasp how the Illinois Comptroller shapes the state’s financial scenario, let’s delve into four areas where this influence is most significant.

a. State Budget Management

In terms of budget oversight, the Comptroller’s office is critical in formulating a budget that reflects the needs and priorities of Illinois. For instance, the 2024 budget initiatives championed by Mendoza aim to enhance funding for education and public health. Such decisions don’t just remain on paper—they directly affect the quality of education our kids receive and how responsive our healthcare systems are.

Using a balanced approach, the Comptroller prioritizes operational efficiencies and invests in necessary social programs. This forward-thinking budgeting style sets the tone for financial health across the state.

b. Transparency in State Spending

We live in times when transparency is non-negotiable. The Illinois Comptroller enhances public trust through initiatives like the Illinois Comptroller’s Open Book program. This online portal opens the veil on state spending, allowing taxpayers to view comprehensive data concerning expenditures. Accessibility to information not only keeps the state accountable but also empowers citizens to make informed inquiries about state spending.

This commitment to transparency promotes responsible financial management, helping citizens become more engaged in local governance. Followed correctly, transparency fosters a more equitable financial environment for current and future generations.

c. Handling the State’s Debt

Managing debt can feel overwhelming, especially for a state like Illinois, which has been grappling with significant liabilities in recent years. The Illinois Comptroller has taken significant strides in debt management strategies. Recent recommendations focus on structured repayment plans aimed at reducing interest burdens over time.

Moreover, effective debt management can improve the state’s credit ratings. Each incremental improvement can result in lower borrowing costs, ultimately benefiting taxpayers by decreasing interest obligations. In this arena, the skillful navigation of finances by the Illinois Comptroller is critical for a stable fiscal future.

d. Response to Financial Emergencies

The agility of the Illinois Comptroller shines through in times of financial crises. During events like the COVID-19 pandemic, the office adapted its procedures to respond to increased demand for financial relief. The Comptroller’s readiness to redirect funds swiftly provided necessary assistance to those affected by the pandemic.

This proactive approach not only facilitated immediate relief but also laid the groundwork for longer-term economic recovery plans. By being forward-thinking, the office maneuvers through crises, ensuring that Illinois can emerge resilient.

Case Studies: The Illinois Comptroller’s Influence on Financial Policy Reforms

Looking at specific instances can further illuminate the Illinois Comptroller’s influence on financial reforms and policies.

a. Pension Reform Initiatives

One of the most pressing challenges has been the state’s underfunded pension systems. The Senate Bill 1, introduced as a response to this crisis, aimed to reform the way pensions are managed. This initiative was a game-changer, allowing the state to establish a clearer funding trajectory while alleviating long-term financial strain.

Ultimately, the developments in pension reform not only tackled past liabilities but also enhanced fiscal predictability. The reforms showcase the potential for change when the Illinois Comptroller takes decisive action.

b. Technology Investments in Financial Oversight

Another powerful reform is the investment in technology for financial oversight. The Illinois Comptroller’s office has integrated automated financial reporting tools that streamline processes significantly. This not only increases administrative efficiency but also promotes timely, accurate reporting.

Consequently, a dive into the Go2bank App can show how innovative tools facilitate better budgeting and spending practices. These technological enhancements become vital weapons against financial mismanagement, promoting greater accountability within government systems.

c. The Impact of Legislative Changes

Legislative proposals that emerge from the Illinois Comptroller’s office have far-reaching implications. Recently, adjustments in tax policies and spending guidelines have been under discussion. These changes are designed to address pressing fiscal issues while maintaining economic stability.

For example, any new tax regulations proposed could directly affect the funding available for essential services. Keeping a close watch on these legislative shifts can provide insights into potential financial outcomes for residents.

Future Challenges Facing the Illinois Comptroller on State Finances

As the Illinois Comptroller looks ahead, several challenges loom on the horizon. First, inflation presents a significant concern for state finances. Rising costs may put pressure on budgets, making financial planning increasingly complex.

Moreover, demographic shifts, with a notable migration of residents out of Illinois, affect tax revenues. This ongoing movement may result in tighter budgets, compelling the Illinois Comptroller to reassess funding priorities continually.

Lastly, the demand for fiscal sustainability is ever-present. Ensuring that finances remain stable requires ongoing effort and strategic initiatives. The office must anticipate challenges proactively, making the role of the Illinois Comptroller more crucial than ever.

Innovative Approaches Towards Enhanced Fiscal Management

In facing future financial hurdles, innovative strategies can lead the way. Public-private partnerships represent a pathway to bolster funding for infrastructure improvements. By collaborating with private entities, the state can leverage additional resources for essential projects.

Budget reform initiatives are also on the table, focusing on prioritizing long-term investments. Engaging stakeholders in financial decision-making promotes shared responsibility and transparency while driving better outcomes for all.

As the Illinois Comptroller moves into 2024, the pursuit of accountability and efficiency in fiscal management remains crucial. By fostering innovation, the office can effectively adapt to financial challenges, setting the stage for a sustainable and secure future.

The influence of the Illinois Comptroller’s office on state finances extends beyond administrative duties. It reflects ongoing efforts to achieve accountability and financial stability. The strategic decisions made today will undoubtedly shape Illinois’ economic landscape for years to come, exemplifying the importance of effective governance in a challenging financial environment.

The Illinois Comptroller: A Financial Beacon

A Historic Overhaul

Did you know that the role of the Illinois Comptroller has evolved significantly since its inception back in 1875? Originally created to keep track of state revenue, the position has become crucial in balancing the state’s finances, especially as Illinois grapples with its budgetary troubles. Much like the adventures in Mario Galaxy, where players navigate through different worlds, the Illinois Comptroller navigates a multi-faceted financial landscape, ensuring the state meets its obligations while also seeking innovative solutions. It’s a job that requires both vigilance and creativity!

Bridging the Gap

Today’s Illinois Comptroller not only handles the checks and balances of state funds but also works closely with various agencies to ensure fiscal accountability. For instance, in 2021, the Illinois Comptroller launched the “Illinois Transparency Portal,” a tool aimed at shedding light on state expenses, much like the Secret life Of Pets reveals the hidden antics of pets left home alone. This transparency helps taxpayers see exactly how their money is being spent, instilling trust in government operations. It’s a refreshing glimpse that reminds us of how engaged citizens can contribute positively to our communities.

Ripple Effects on Everyday Life

You might be surprised to learn that the actions of the Illinois Comptroller extend beyond governmental budgets. By streamlining payment processes and keeping tabs on spending, the Comptroller’s office plays a vital role in supporting local businesses, ensuring they get paid on time. Imagine trying to run a small business while waiting for payments—sort of like waiting to see if Jay Z’s house gets raided, right? That uncertainty can affect how businesses operate daily. Furthermore, efficient financial management encourages investment opportunities within the state, similar to how Wagon Wheels draw attention to significant cultural stories. It’s all about creating a thriving economy for everyone involved!

So, the next time you hear about the Illinois Comptroller, consider the ripple effects their decisions have on the community and the economy. Just as the players in San Jose state boise State Volleyball rely on teamwork, the Comptroller’s role significantly impacts everything from budgeting to transparency. In a state with a rich history and diverse challenges, the Illinois Comptroller shines as a symbol of fiscal responsibility and dedication to the public good. Don’t miss the chance to dive deeper into how their work influences both the present and future of Illinois finances!