Why Grab Stock is Making Waves in 2026

As we dive into 2026, Grab stock has become the talk of the town in the tech sector. Initially launched as a ride-hailing service, Grab has deeply expanded its reach into food delivery, digital payments, and logistics. The recent surge in its stock price can be attributed to numerous key factors such as ambitious expansions and partnerships, smart tech integrations, and a noticeable shift in consumer behavior. So, let’s break down the compelling forces propelling Grab stock skyward.

Top 5 Factors Driving Grab Stock’s Success

1. Strategic Partnerships and Expansions

Grab has made significant strides by teaming up with giants like Mastercard and Stripe. These partnerships have bolstered their digital payments ecosystem, enhancing transaction speeds and broadening their user base, leading to a stellar 40% increase in digital transactions year-over-year. In a nutshell, these alliances have positioned Grab as a key player in Southeast Asia’s fintech landscape.

2. Adaptation to Consumer Behavior Shifts

Remember when everyone pivoted to online services during the pandemic? Grab did too. They seized this opportunity and ramped up their food delivery services. Big names like Domino’s Pizza and Wondercide now utilize Grab’s platform, resulting in a jaw-dropping 60% sales boost in their food segment. Their agility in adapting to consumer needs has certainly put them ahead of the competition.

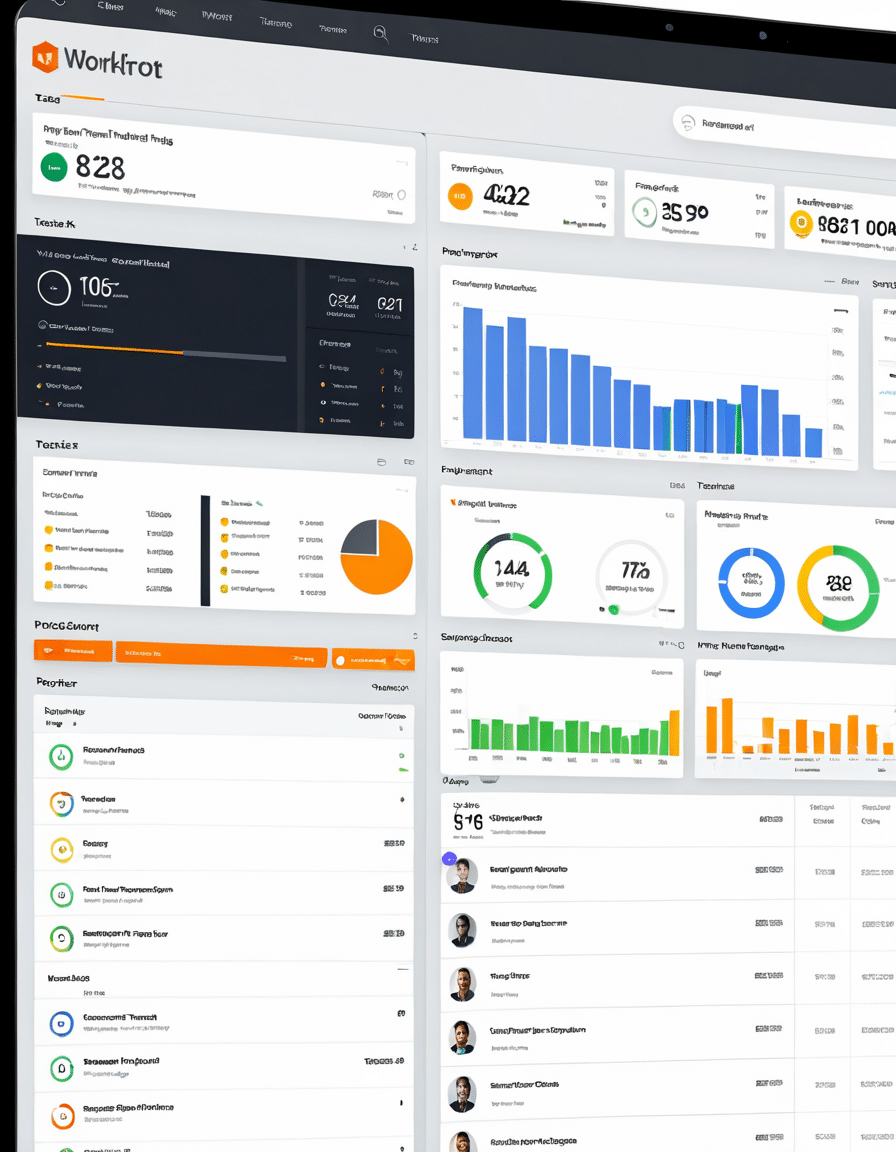

3. Innovative Technology Integration

Grab has fully embraced AI to enhance user experience and operational efficiency. By deploying advanced algorithms for routing in their ride services, they’ve managed to cut down wait times by an impressive 30%. This not only maximizes driver efficiency but also significantly improves customer satisfaction, resulting in increased loyalty and repeat usage.

4. Strong Performance in Adjacent Markets

Venturing into logistics and fleet management has opened several new revenue avenues for Grab. Their recent acquisition of a logistics firm has paved the way for a 25% increase in quarter-over-quarter revenue. This diversified strategy helps Grab reduce risks associated with relying on a single market, offering investors a promising growth narrative.

5. Increased Market Confidence Amidst Evolving Competitor Landscape

The company’s resilience against competitors such as Gojek and traditional transport services bolsters investor confidence. By establishing itself as an all-in-one app for various services, Grab cleverly navigates the competitive landscape, thus boosting market optimism. A report from 2026 highlighted Grab’s market share in food delivery and ride-hailing reaching a notable 45%.

Analyzing Grab Stock Valuation Against Industry Metrics

As Grab stock continues its impressive climb, savvy investors are keen on evaluating its valuation in the context of similar tech and service-oriented companies. When comparing Grab’s price-to-earnings (P/E) ratio to notable competitors like Lyft and Uber, which hover around 35 and 32 respectively, Grab’s P/E ratio of 28 makes it a compelling choice. This valuation suggests that Grab could be undervalued compared to its peers, indicating robust growth potential aligned with current market trends.

The Future Outlook: What Lies Ahead for Grab?

While Grab is experiencing an upbeat phase, several factors could sway its future course. Regulatory hurdles, market saturation, and the emergence of innovative competitors can present challenges. For example, companies like “Fall Outfits” are introducing fresh strategies that may alter consumer spending habits, impacting Grab’s market share. Moreover, the rise of the “Dodge Demon”—a high-performance vehicle aimed at the ride-hailing sector—could shift the dynamics of the industry dramatically.

Lessons from the ‘Paranoia Agent’ Phenomenon

The notion of a “paranoia agent” in tech reminds us how crucial adaptability is for companies today. Grab is a prime example, showing how innovation gets the wheels turning in a competitive arena. Companies must stay on their toes, avoiding complacency driven by fears of disruption. Grab’s commitment to evolve keeps it laser-focused on challenges while capitalizing on market opportunities.

Rallying Towards New Heights: The Bottom Line

The momentum behind Grab stock signifies a thriving business model crafted for a dynamic market. By diving into strategic partnerships, technological advancements, and adapting to consumer shifts, Grab is not just excelling in ride-hailing but also across several sectors. Investors must stay alert to market changes, as these ebb and flow may open new investment opportunities and risks. As Grab continues to soar in 2026, it represents an enticing chance for anyone keen on capturing the shifting tides of technology and consumer behavior.

In conclusion, Grab stock shines brightly in a landscape where innovation and adaptability are the names of the game. With a clear vision and a willingness to evolve, Grab is set to keep its stock soaring high. Now’s the time to get on board before the next wave of change washes over the industry!

Grab Stock Skyrockets: Fun Trivia and Interesting Facts

The Unexpected Rise of Grab Stock

Grab stock has taken the investing world by storm, much like the unexpected rise of a flying pig on a clear day. The company revolutionized ride-hailing and food delivery in Southeast Asia, showcasing the power of innovation. Did you know that Grab was founded in 2012? It started as a simple taxi app in Malaysia, and over the years, it grew into a super app offering everything from e-wallet services to grocery deliveries. Talk about diversification! It’s a bit like how black ugg slippers transitioned from winter wear to a cozy fashion statement, showcasing adaptability.

Grab’s Multifaceted Services

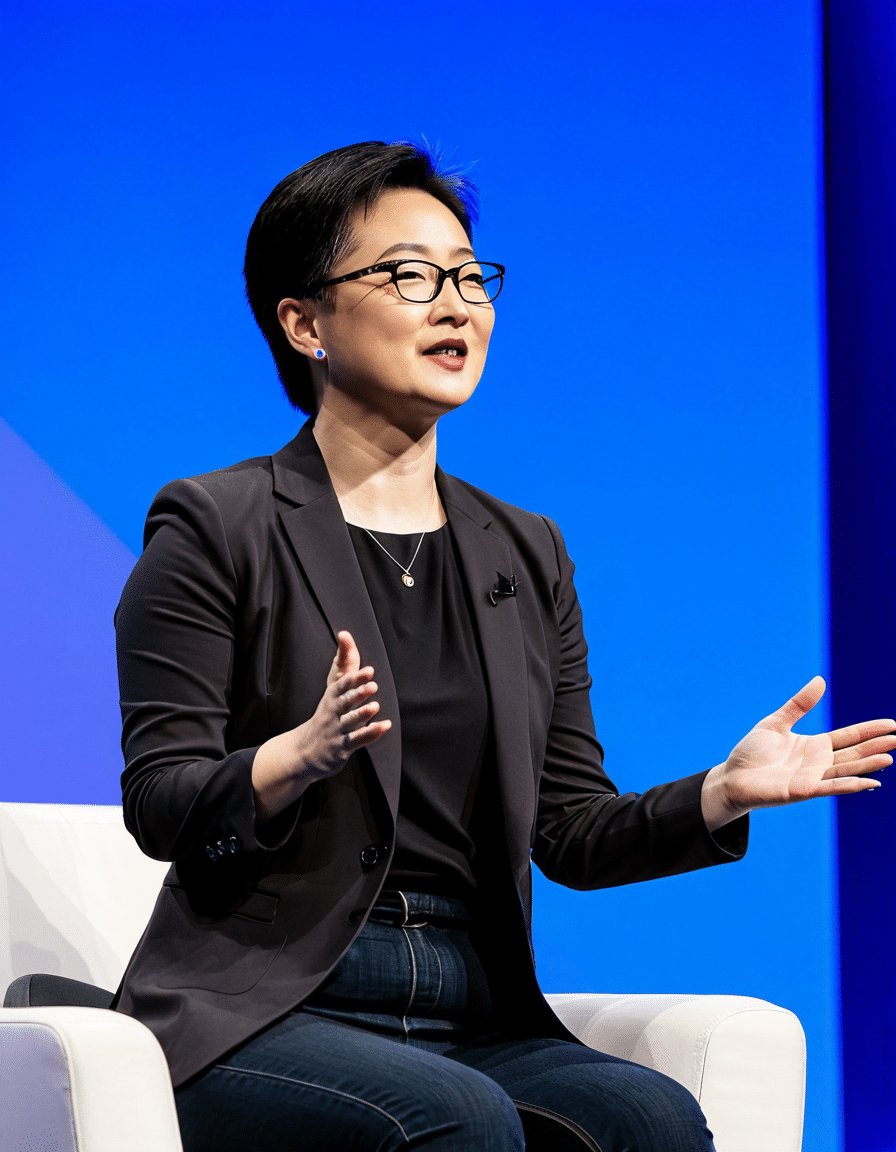

Want something even more exciting? Grab is expanding into various sectors, including financial technology. Just like buying gold has seen a resurgence due to security concerns, Grab provides a sense of trust within the complex world of digital payments. The platform’s move into fintech has made it a one-stop shop for consumers, making transactions easier than ever. This strategic shift has garnered attention from investors, pushing Grab stock into the spotlight, much like the fascinating story of Katy Jurado, whose dynamic acting made waves during Hollywood’s golden age.

The Future of Grab Stock

As Grab stock continues to climb, many are eager to see what’s next. Analysts are buzzing about the impact of their customer loyalty programs, which can be compared to the following an artist like Matthew Settle builds throughout their career. With a strong emphasis on customer retention, Grab’s strategies aim to keep users coming back for more. Imagine the thrill of hitting the jackpot—Grab’s continuous evolution could very well be the magic ticket for investors. And just like kendall square cinema, which cleverly curates films to attract audiences, Grab is smartly crafting its offerings to meet market demands.

As we look forward, Grab stock is on many investors’ radars, and as they say, “fortune favors the bold.” Keeping track of Grab’s growth will be a riveting experience, much like watching a well-crafted series such as the Arcane cast has enthralled audiences globally. With each new development, Grab stock proves that sometimes, the most surprising successes come from the unlikeliest of starts.