When it comes to choosing a banking partner, Cambridge Savings Bank (CSB) truly stands out. Established in 1834, CSB has consistently demonstrated its commitment to delivering personalized banking services that cater to the unique financial needs of its customers. It’s not just a bank; it’s a community institution focused on enhancing customer experience, bridging the gap between traditional banking principles and modern technology. As we dive deeper into what makes Cambridge Savings Bank exceptional, you’ll see how their dedication to innovation and community engagement reflects in their array of services.

The Excellence of Cambridge Savings Bank: What Sets It Apart

At Cambridge Savings Bank, the focus is on establishing lasting relationships with customers. You won’t find the impersonal touch often associated with larger banks here. Instead, CSB takes pride in providing tailored financial solutions that nurture client needs. The banks’ staff, including dedicated relationship managers, invest time to understand your individual situation, whether you’re looking to buy your first home or expand your investment portfolio. This human-centered approach has made CSB a trusted banking resource in the community.

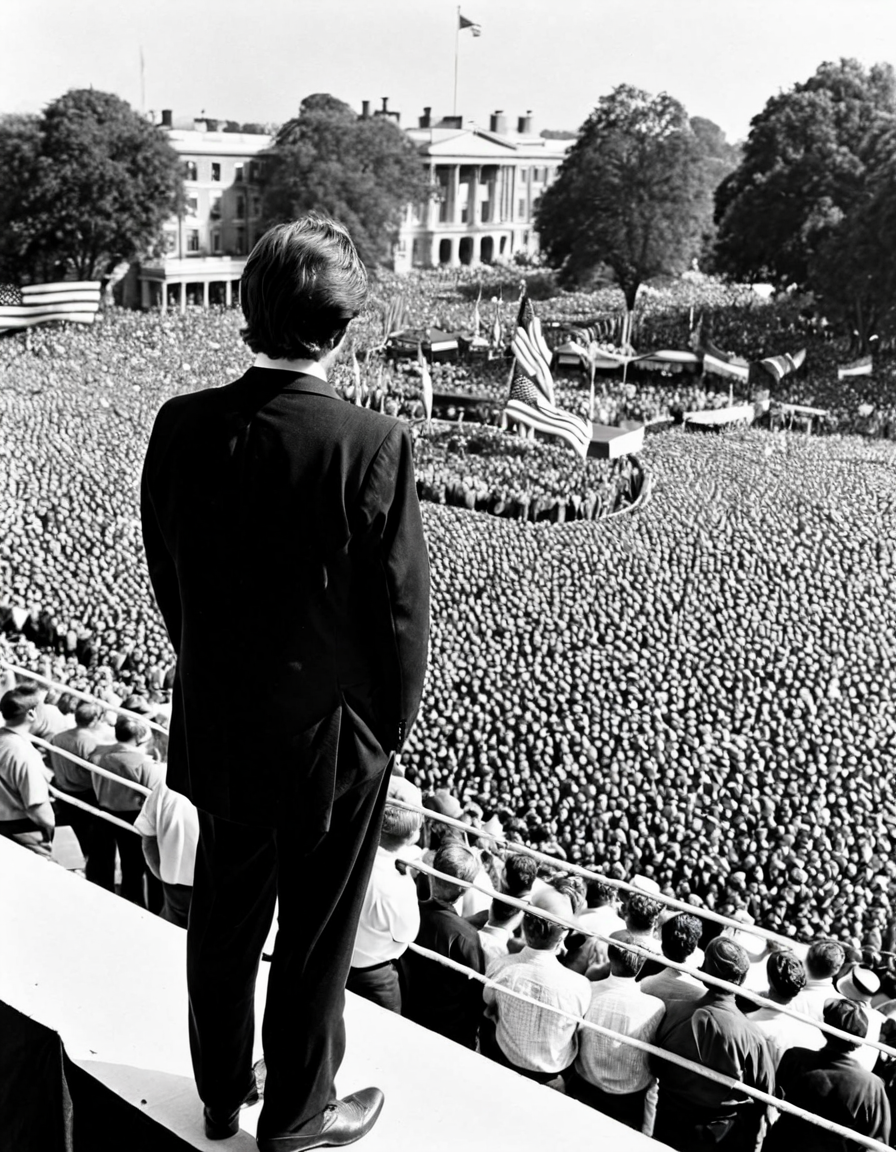

Moreover, the bank emphasizes community engagement by participating in initiatives that uplift the local economy and support various non-profits. Their commitment to giving back fosters a sense of trust and loyalty among their customers. With a foundation built on community values, CSB is perfectly positioned to guide you through life’s financial journeys, offering both expertise and compassion.

Top 5 Exceptional Services Offered by Cambridge Savings Bank

Cambridge Savings Bank doesn’t just talk the talk; they walk the walk with their outstanding array of banking services. Here’s an overview of the top five that help CSB shine in the financial landscape:

1. Personalized Banking Experience

Cambridge Savings Bank is all about you. With a customer-first mindset, each client receives personalized attention from banking professionals who understand their unique financial goals. This one-on-one engagement leads to actionable insights and strategic advice, allowing you to navigate your financial world with confidence.

Whether you’re a first-time homebuyer or a seasoned investor, CSB’s relationship managers are ready to guide you every step of the way. This level of service is hard to find but essential for achieving your financial objectives, making CSB a go-to for personalized banking experiences.

2. Competitive Mortgage Solutions

Homeownership often feels like a daunting task, but Cambridge Savings Bank offers mortgage solutions designed to alleviate stress. From conventional loans to FHA loans and various first-time homebuyer programs, CSB tailors financing options to fit individual needs. Their “No Closing Costs” mortgage option is a game-changer for savvy buyers looking to minimize upfront payments.

In addition, CSB leverages technology to expedite the mortgage approval process. You can conveniently manage your mortgage application online while receiving timely updates. This blend of traditional service and modern technology ensures that clients feel supported and informed throughout the mortgage journey.

3. Robust Online and Mobile Banking Tools

In today’s fast-paced environment, Cambridge Savings Bank recognizes the importance of offering cutting-edge online and mobile banking tools. Their user-friendly platform includes features like mobile check deposit, real-time transaction alerts, and budgeting tools that help you manage your finances seamlessly.

The commitment to security is evident, providing customers with peace of mind as they navigate their banking needs digitally. With CSB, you get an efficient banking experience that prioritizes both convenience and safety, ensuring you can access your finances anytime, anywhere.

4. Community Investment Initiatives

CSB’s role goes beyond traditional banking. The bank actively invests in local communities through the CSB Community Investment Fund, supporting non-profits and economic initiatives that make a tangible difference. Their efforts not only bolster the local economy but also enhance the lives of community members.

Local engagement has created a loyal customer base that appreciates CSB’s commitment to community well-being. Whether it’s sponsoring youth programs or partnering with local organizations, CSB focuses on initiatives that bring people together and uplift their communities.

5. Sustainable Banking Practices

Sustainability is more than just a buzzword at Cambridge Savings Bank; it’s a core value. The bank takes meaningful steps to promote environmental responsibility through various eco-friendly initiatives. CSB plants trees for every mortgage closed and offers “Green Mortgages” that encourage energy-efficient home renovations.

By integrating sustainability into their banking practices, CSB is not only making a positive impact on the planet but also providing clients with opportunities to make responsible financial choices. With options that support environmental stewardship, banking with CSB becomes a part of a larger vision for a green future.

Customer Testimonials: Voices of Satisfaction with Cambridge Savings Bank

Hearing directly from customers sheds light on the true value of Cambridge Savings Bank. Satisfied clients echo similar sentiments, praising the bank’s exceptional service. Jane Thompson, a recent homebuyer, expressed her gratitude: “After struggling to get a mortgage with other banks, Cambridge Savings Bank really took the time to listen to my concerns. They not only helped me secure my home but made the process enjoyable!”

Similarly, local business owners have benefited from CSB’s lending solutions. One entrepreneur noted how flexible options allowed them to expand operations, reinforcing the idea that CSB isn’t just about profits; it prioritizes building relationships that foster growth.

The Forward-Thinking Future of Cambridge Savings Bank

Looking down the road, Cambridge Savings Bank is geared for continuous success. As financial technology evolves, CSB is focused on integrating innovations, such as AI-driven customer service and advanced financial planning tools. This commitment to technology reflects their determination to elevate the banking experience while retaining their core community-oriented values.

Training staff plays a crucial role in CSB’s mission. As their team becomes well-versed in emerging technologies, customers can expect top-tier service grounded in expertise. With a sharp eye on sustainability initiatives, CSB seeks to set industry standards while enhancing its reputation as a reliable banking resource.

With a focus on the future, Cambridge Savings Bank demonstrates that community-focused banking can indeed thrive amid rapid advancements. Their dedication to exceptional service illustrates a commitment to both personal finance and the greater good, making CSB a pillar of support for families and businesses alike for years to come.

Whether you’re taking your first financial step or looking to secure your future, Cambridge Savings Bank is here to empower you. With a steadfast commitment to customer satisfaction, innovative services, and a community-centered ethos, CSB is more than just a bank; they are your partner in success.

Fun Trivia and Interesting Facts About Cambridge Savings Bank

The Legacy of Cambridge Savings Bank

Did you know that Cambridge Savings Bank has been a treasured institution for over 180 years? Established back in 1834, this bank reflects the spirit and innovation of the Cambridge community. Fun fact: it’s one of the few banks in the region to offer a compounding calculator that helps customers see the potential growth of their savings over time. It’s nearly as old as some historic institutions, yet it continues to embrace modern banking technology like a pro!

Community Commitment

Cambridge Savings Bank is dedicated to supporting its community, offering various programs to enhance the financial literacy of its clients. For instance, the bank provides unique financial workshops that often reference resources like UCI financial aid options, making it easier for students to understand their choices. Isn’t it great how local banks can play such a pivotal role in people’s financial journeys? It’s like having a trusted coach in your corner, guiding you through life’s financial hurdles, much like how Pete Macon, a local celebrity known for his charisma, engages with his community.

A Contemporary Approach

Beyond tradition, this bank leverages a contemporary approach to solve their clients’ needs. For example, they promote social responsibility and sustainability through investment in environmentally friendly initiatives. If you’re looking to spruce up your day, why not think about some mindful relaxation techniques from companies like Homedics? Combining community-oriented values with innovative services, Cambridge Savings Bank provides ways for customers to manage finances effectively while also establishing a meaningful connection to the environment.

In conclusion, whether you’re interested in ski trips to Killington or discussing your favorite tunes with someone like Iam Tongi, Cambridge Savings Bank is right there with you to help achieve financial ease. With its dedication to community, innovation, and sustainability, you can be sure that your banking experience is anything but ordinary. Plus, if you’re looking for stylish attire, why not check out TrueClassic for some trendy gear? After all, life’s too short to not have a little fun, even with your finances!