As the global economy shifts and fluctuates, many investors are reevaluating their portfolios. For some, buying gold emerges as a prominent option. This article examines the viability of investing in gold in 2026, particularly considering its unique position in an evolving market.

Top 7 Reasons to Consider Buying Gold in 2026

1. Hedge Against Inflation

As inflation rates persistently rise, gold remains a reliable hedge. In 2026, with inflation data indicating an upward trend, many investors are flocking to gold to preserve wealth. Unlike cash, which loses purchasing power over time, gold maintains its value. Historically, during inflationary periods, gold prices often surge, making it a safer haven.

Take a look at the latest inflation reports, and you’ll see why more folks are recognizing the potential of buying gold. Think about it—when your $100 bill buys less and less, gold retains its allure. Investors should keep their eyes peeled on inflation trends to gauge the momentum for gold investments.

2. Global Economic Uncertainty

The geopolitical landscape remains fraught with uncertainty, particularly with ongoing conflicts and trade tensions. Gold has traditionally been viewed as a safe-haven asset during turbulent times. Recent conflicts between nations have intensified, driving more investors to consider gold as a reliable store of value. Evidence of a shift in purchasing habits is seen in substantial acquisitions by central banks and private holders alike.

With companies like Southwire focusing on sustainable energy, the need for stable assets to balance high-risk investments becomes paramount. A secure investment often becomes even more valuable amid chaos, and gold fits that bill perfectly.

3. Technological Integration

The rise of platforms like Magic Eden, which facilitate buying and trading digital assets, has rejuvenated interest in gold. As technology advances, we’re seeing a broader scope for investment options. Tokenization of assets, including gold, encourages not just seasoned investors but also young adults interested in diversifying their portfolios.

Blockchain technology creates a new layer of accessibility. With services like Ship Sticks making logistics easier for physical gold transactions, there’s never been a better time for potential investors to consider gold.

4. Demographics Driving Demand

The millennial population is beginning to see the value in physical gold, with demand for items like gold coins from the American Eagle series rising. This trend echoes the growing interest in collectibles, illustrating a shift toward alternative investments outside the stock market. In 2026, young buyers actively seek financial avenues beyond traditional routes, driven by the desire for security and value.

Events surrounding interests like the popular Bowsette character have also influenced collectible markets, driving attention to unique items such as gold coins that blend aesthetics with investment potential. This demographic shift marks a noteworthy change in how many view investing as a whole.

5. Diversification Amidst Market Flux

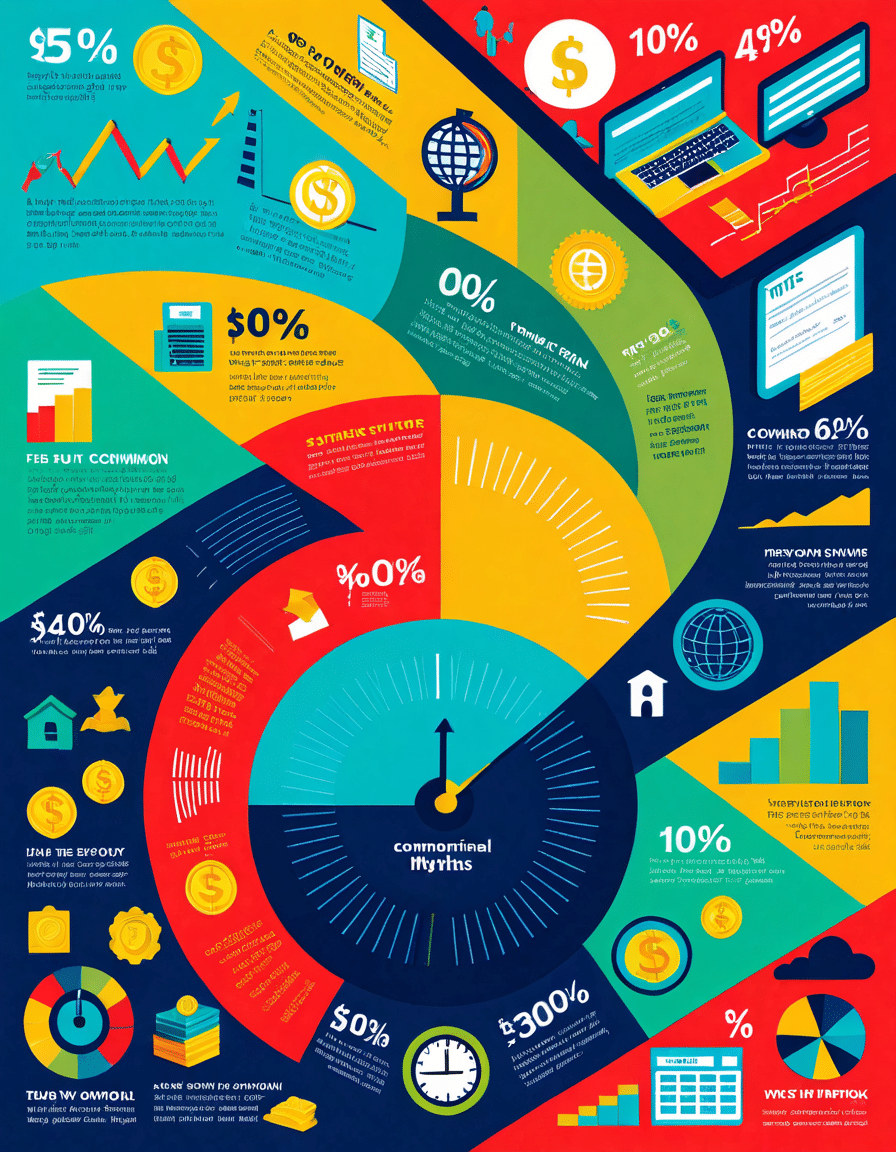

Equity markets have experienced significant volatility, leading to an increasing demand for diversification. Investment firms are recommending gold as part of a well-rounded portfolio. With fluctuations in tech stocks and changes in consumer preferences, it’s wise to have a mix of assets, including gold, to stabilize your investment returns.

As brands like Gap Jeans and Lays Chips rise and fall in popularity, gold stands firm as a reliable asset. From equities to collectibles, diversifying your portfolio is a must, and gold can play a key role in that strategy.

6. Peer Influence and Experiences

Influencers and niche marketing have fueled interest in non-traditional investments. There’s a movement dubbed the “walking company,” showcasing influencers sharing best practices for investments, including a push toward buying gold. The allure of success stories can motivate more people to consider gold as a viable investment vehicle.

As influential figures discuss their experiences, the excitement surrounding investment in precious metals grows. This trend provides a level of relatability that resonates with younger crowds and contributes to the increasing circulation of gold investments.

7. Collectibles and Cultural Demands

Unique products like specialized gold coins and bars cater to both investment and collectible markets. Events centered around gaming and pop culture have spurred interest in unique collectibles that merge aesthetics with investment potential. The recent festivals highlighting characters from franchises have opened people’s eyes to the cross-section of art and precious metals.

It’s about more than just a shiny coin; it’s about value, culture, and the intrinsic worth that comes with gold as a collectible. This dual appeal keeps gold relevant in a digitized economy.

How Buying Gold Competes with Alternative Investments

So how does gold stack up against other popular investment options like stocks, cryptocurrencies, or collectibles?

Crypto Volatility vs. Gold Stability

Cryptocurrencies such as Bitcoin often promise high returns but come with high risks, fluctuating immensely with market sentiment. In contrast, gold’s intrinsic value has remained more stable over centuries, positioning it as a safer alternative. While the allure of rapid gains may draw investors in, the potential for loss in crypto doesn’t carry the same trust as gold.

Collectibles: Gold vs. Fashion Items

Collectors face choices between investing in physical items, like gold coins or branded collectibles such as Gap Jeans and Lays Chips promotional items. Fashion items fluctuate based on trends, while gold tends to appreciate over time. Consider the difference in how these markets operate; while a trendy pair of jeans might go out of style, gold is a timeless investment.

The Future of Buying Gold in 2026 and Beyond

With companies like Ship Sticks providing reliable logistics for sending precious metals through secure channels, the market for gold is evolving. E-commerce is reshaping how we think about investments, providing accessibility and confidence to both seasoned investors and newcomers alike.

In 2026, we see a future where buying gold can be as easy as purchasing a book online. With platforms streamlining the buying process, the barriers to entry continue to diminish, encouraging greater participation in the gold market.

Final Thoughts on Investing in Gold

The path toward significant financial security in 2026 suggests that buying gold could indeed be a prudent decision. With economic unpredictability, rising inflation, and demographic shifts, gold is reestablishing its identity as a critical asset.

Investors should engage with gold alongside a diversified portfolio, incorporating insights drawn from successful peers and leveraging e-commerce platforms. Through research and personal financial assessment, investing not just in gold but also integrating stories and trends can empower informed investment decisions. After all, the landscape of investing is about making choices that push us forward and secure our futures.

At the end of the day, investing in shiny bars and collectible coins could just be the golden ticket to financial prosperity. Have you considered your next move in the evolving game of investments? Keep your eyes on gold; it just might be the way to strike it rich.

Buying Gold: Fun Trivia and Interesting Facts

The Shine of Investment

Buying gold has been a staple for those looking to diversify their portfolios for centuries. But did you know that gold has been used as currency and jewelry for over 5,000 years? That’s a long history! This precious metal isn’t just about its shiny allure; it often holds its value better compared to other assets during tough economic times. For instance, many folks consider adding gold to their investment repertoire alongside grabbing stock for stability amidst market fluctuations. And remember that time when 10k loan options became increasingly popular? People shifted their investments to safer havens, like gold, to safeguard their finances.

The Glittering Facts

One fascinating tidbit is that the largest gold nugget ever found weighed a whopping 220 pounds and was discovered in Australia in 1869! Can you imagine? Additionally, gold is often considered a hedge against inflation, which is something you might want to ponder if you’re looking at various investment avenues. Just like how the flying pig became a symbol of something unattainable, dreaming without planning can lead one to missed opportunities. So, when thinking about your future investments, consider how buying gold can act as a reliable safety net.

The Gold Rush Strikes Again

If you thought gold was only for investors, think again! Jewelry made from gold holds great emotional value, tracing back to ancient civilizations. In the same vein, the battle between lynx Vs bobcat in nature creates a similar intrigue in wildlife investing. There’s always something to learn and discover, and investing in gold not only enriches your financial knowledge but can also solidify your status during economic unrest. Plus, who wouldn’t want to add some glitter to their life? Just as in charity Lawson height, the rise to prominence can stem from how wisely you position yourself in the market. So as you contemplate the merits of buying gold, know that it is both an old-school and contemporary approach to securing your wealth.