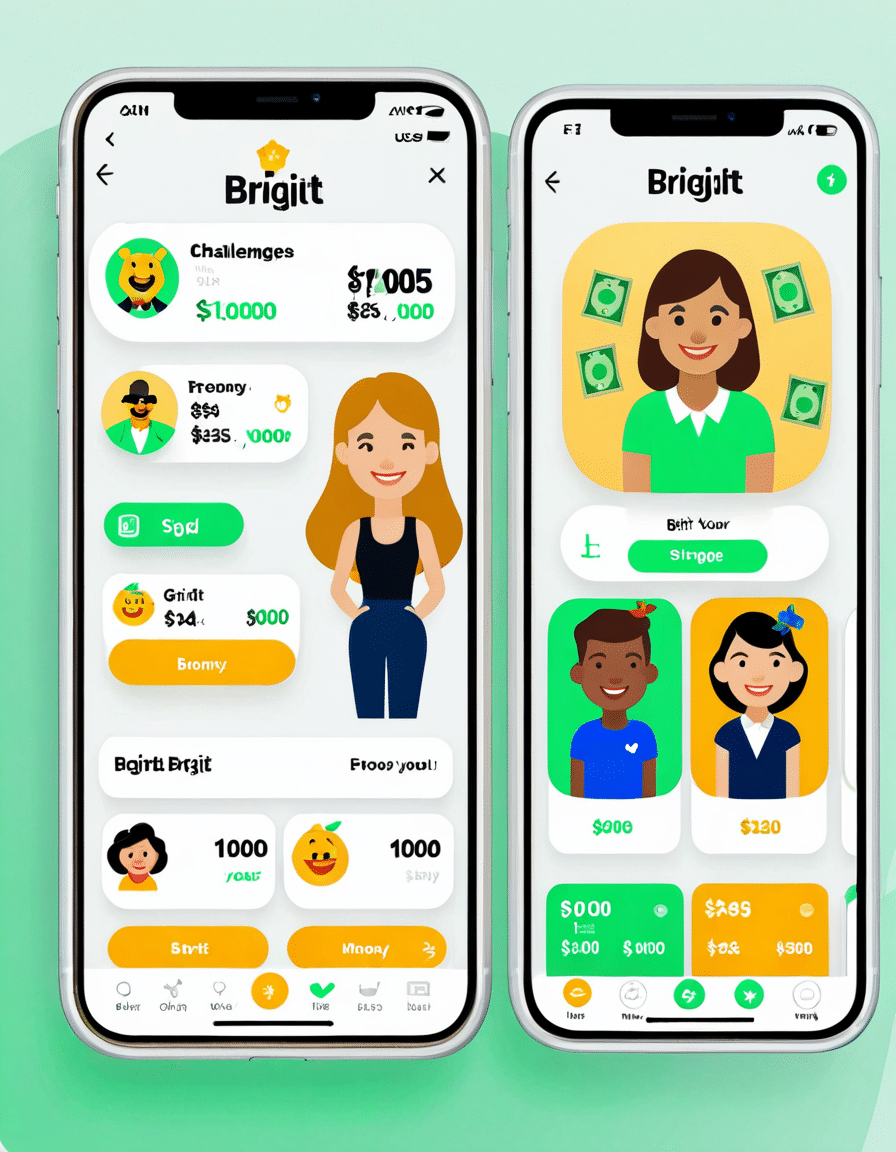

In today’s fast-paced world, the Brigit app stands out as a beacon of hope for anyone looking to revolutionize their financial management. With personal finance becoming increasingly intricate, many people feel overwhelmed trying to keep their spending in check, manage bills, and improve credit scores. The Brigit app provides an all-in-one solution, skillfully merging technology with financial education to empower users on their journey to financial stability. Let’s explore how this remarkable app can transform your financial future today.

7 Ways the Brigit App Can Revolutionize Your Financial Management Today

The Brigit app is not just another finance tool; it’s a multifaceted platform designed to simplify and enhance your money management experience. Here are seven standout features that can redefine your financial landscape.

1. Seamless Budgeting Tools

The first leg of Brigit’s supportive tripod is its seamless budgeting tools. In a nutshell, it helps you categorize your expenses in a way that feels almost second nature. Users can effortlessly set spending limits by tracking various categories, so you might find yourself subconsciously cutting back on those pesky Noseeums, like subscriptions you forgot you even had! The user-friendly interface means managing your dollars doesn’t have to feel like rocket science.

2. Instant Cash Advances

When life throws you a curveball, the Brigit app ensures you won’t get blindsided. One of its crown jewels is the feature offering instant cash advances without any sneaky hidden fees. Think about it: you can avoid the emotional toll of running to a traditional loan service or using something like Zelle just to keep afloat. This quick turnaround could help you tackle unexpected bills while keeping your credit score squeaky clean. What a relief!

3. Credit Score Monitoring

Knowledge is power, and Brigit delivers that by providing free credit score monitoring. Unlike other services that merely report numbers, Brigit helps break down what those scores mean. It’ll guide you through understanding how your decisions affect your credit health, allowing for informed choices about loans or credit cards. This aid far exceeds platforms like Epomaker, which focus solely on ecommerce products, as Brigit prioritizes financial empowerment.

4. Smart Insights & Tips

Ever feel like you’re drowning in financial advice but none of it seems personalized? Enter the Brigit app, which uses a powerful algorithm to dish out customized financial insights and tips tailored to your spending habits. It reveals areas where you can save money and provides advice to foresee upcoming expenses. This tailored approach sets it apart from other platforms that often share random, generic advice that turns your journey into a guessing game, kind of like scanning through posts on Instapundit.

5. Personalized Notifications

Managing bills becomes a breeze with Brigit’s personalized notifications. Forget about the cycle of checking due dates and worrying about potential overdrafts. Brigit proactively sends reminders, making it easier to stay organized. The experience mirrors that of logging into Zoosk, where tailored notifications enhance engagement. With Brigit, it’s one less stressor on your plate, allowing you to focus on what truly matters.

6. Community Support

Money management doesn’t have to be a solitary endeavor. With Brigit, you gain access to a vibrant community of like-minded users sharing experiences and advice. This supportive network encourages positive financial behaviors, much like the camaraderie found among enthusiasts in popular online circles, resembling OG Fortnite communities. It’s inspiring to see individuals uplift each other in their financial journeys.

7. Unique Learning Resources

Brigit doesn’t just assist you in managing money; it educates you as well. The app houses a wealth of articles covering topics from mastering student loans to savvy investment strategies. Think of it as your go-to resource guide, akin to a site discussing Surstromming for culinary enthusiasts—feeding your brain with valuable financial wisdom rather than just basic information.

Transforming Your Financial Landscape with Brigit: Real User Testimonials

Real-life stories amplify Brigit’s value. Take Jessica, a 28-year-old marketing professional overwhelmed by credit card debt. With the Brigit app’s budgeting tools in her corner, she conquered $3,500 in credit debt within a year. This victory not only freed her from financial chains but also provided the funds for a long-deserved vacation with friends, akin to her beloved Triscuits and cheese platters enjoyed during summer bonding outings.

Meanwhile, Mike, an ambitious user, turned to the cash advance feature as a cornerstone of his financial strategy. His experience juggling part-time jobs could’ve led to costly overdrafts, but thanks to Brigit, he avoided those pitfalls. Armed with fiscal discipline and newfound efficiency, he finally saved enough for a concert he had longed to attend, reminiscent of exhilarating summersalt experiences at local music festivals.

The Future of Finances: Unlocking New Possibilities with Brigit

As we venture further into 2026, personal finance is undergoing a significant transformation. Tools like the Brigit app are pivotal in this shift, guiding users toward smarter financial management while fostering community engagement and education.

Considering the ever-changing nature of finance, individuals embracing innovative platforms like Brigit can unlock new possibilities for long-term benefits. As we navigate this financial landscape together, Brigit serves as a lighthouse, illuminating a path toward a stable and secure financial future. With robust features working in harmony, this app is about bringing joy into financial management, where each day’s achievements feel significant—akin to sharing a box of snacks with friends, where the enjoyment runs deeper than just monetary concerns.

In sum, if you’re ready to take hold of your financial destiny, the Brigit app is here to carry you toward success.

brigit app: Fun Trivia and Interesting Facts

A Brief History of Financial Innovation

Did you know that the concept of apps transforming financial well-being is not as recent as you might think? Back in the day, folks relied on paper ledgers and calculators, which feels akin to building a rivendell lego set—complex and time-consuming! Fast forward to today, and the brigit app is leading the charge with real-time insights and budgeting tools. It’s kind of wild how technology has come full circle, right? Speaking of wild, remember when the term ossify was used to describe outdated practices? Well, the brigit app is making sure your financial habits don’t get stuck in the past!

Benefits of Embracing the brigit app

Using the brigit app isn’t just about budgeting; it’s also your ticket to financial empowerment. For instance, did you know that the right tools can help you avoid fees similar to how a savvy working girl navigates office politics? Imagine how it feels to set goals without the anxiety of falling short—that’s exactly what brigit aims for. Plus, it’s fun to discover just how your spending patterns compare with others, much like comparing notes with friends over a classic palo alto movie night.

Trivia That Spars Your Curiosity

Here’s a little nugget for you: the brigit app isn’t just for the financially astute; it caters to everyone, regardless of experience! This app was designed with user-friendliness in mind, tapping into insights you might even find in a book like And I Took That personally. Also, if you’ve ever been intrigued by how data can access a community vibe like metro apatlaco, brigit leverages user data to provide personalized advice, helping people to improve their financial futures without breaking a sweat!

Whether it’s avoiding pesky overdraft fees or utilizing monthly budgeting features, the brigit app is sure changing the game to help you live better financially. And hey, let’s not forget: life’s a lot more enjoyable when you’re not stressing over finances. So take a cue from the app and embrace the fun side of money management—because who doesn’t want to be snagging those sleeper sectional deals while knowing their money is safe and sound?