When it comes to finding a financial institution that not only meets your needs but goes the extra mile, AllSouth Federal Credit Union shines. This credit union understands what its members want and delivers with exceptional benefits aimed at creating financial harmony for individuals and families. Let’s dive into the top seven benefits that separate AllSouth from the competition, particularly when stacked against Centra Credit Union.

1. Top 7 Benefits of Membership at AllSouth Federal Credit Union

1. Competitive Interest Rates on Loans

2. No Monthly Fees on Checking Accounts

Say goodbye to unnecessary fees! AllSouth offers checking accounts that come devoid of monthly maintenance charges. This innovative approach allows members to retain more of their hard-earned money. In contrast, Centra requires a minimum balance, which can be a real drag for budget-minded folks.

3. Comprehensive Educational Resources

Knowledge is power, and AllSouth Federal Credit Union knows it well. They boast a treasure trove of financial education resources, from workshops on budgeting to webinars focusing on credit scores and home buying. Unlike Centra, which may have limited training options, AllSouth actively supports members with a substantial library of information, empowering them to make solid financial choices.

4. Rewards Program for Debit Card Users

AllSouth doesn’t stop with banking; they reward you for spending too! With their debit card rewards program, members can earn cashback on day-to-day purchases. Wow! That’s a distinct perk when you compare it to the straightforward services offered at Centra, which lacks such enticing rewards.

5. Exclusive Member Discounts

Being part of AllSouth means tapping into some great exclusive discounts with local businesses. Whether it’s at retail stores, local restaurants, or fitness centers, members cash in on benefits that not only enhance their lives but also fortify community ties. This hometown spirit is something that Centra can’t quite match.

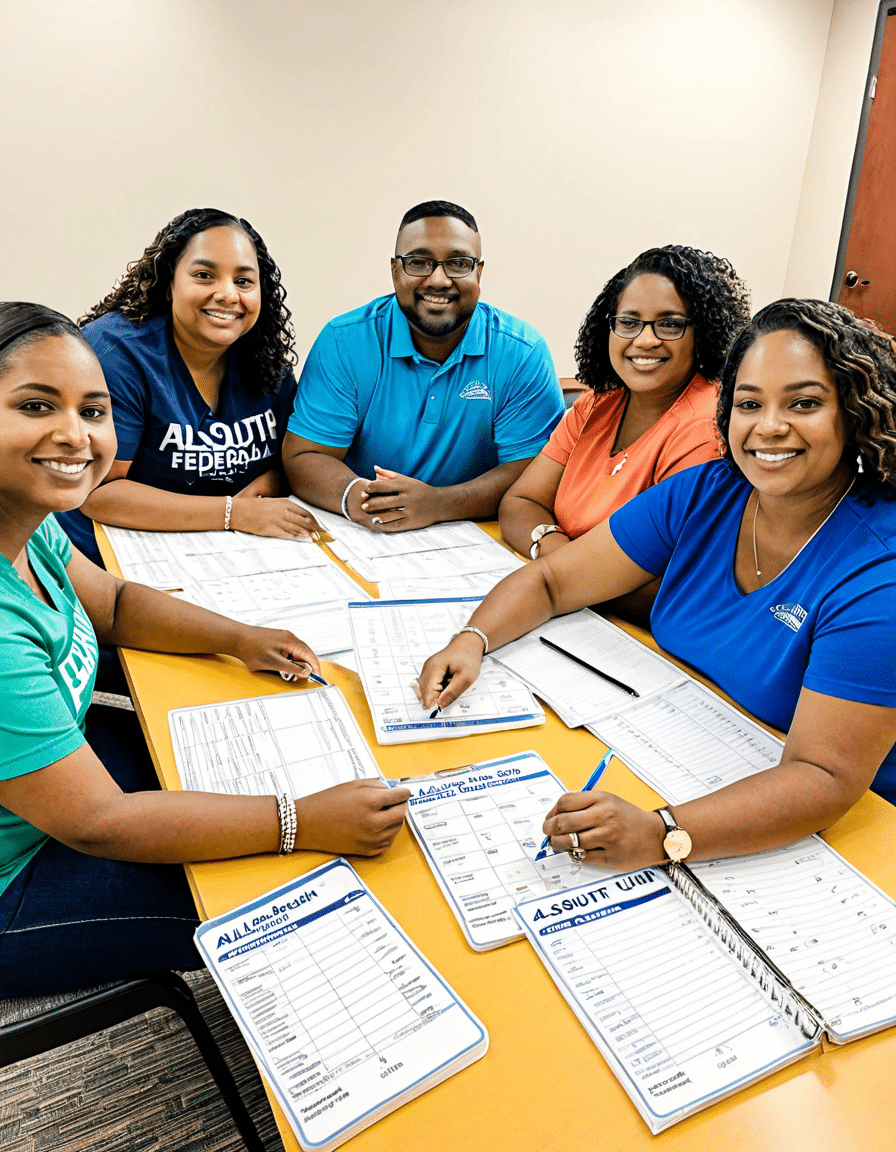

6. Personalized Customer Service

Ever feel like just another number in a huge bank? Not at AllSouth Federal Credit Union. Members often rave about shorter wait times and a more personalized touch. While Centra is known for its impressive scale, that can sometimes lead to a chilly sense of service. AllSouth focuses on fostering strong connections between members and staff, making you feel valued.

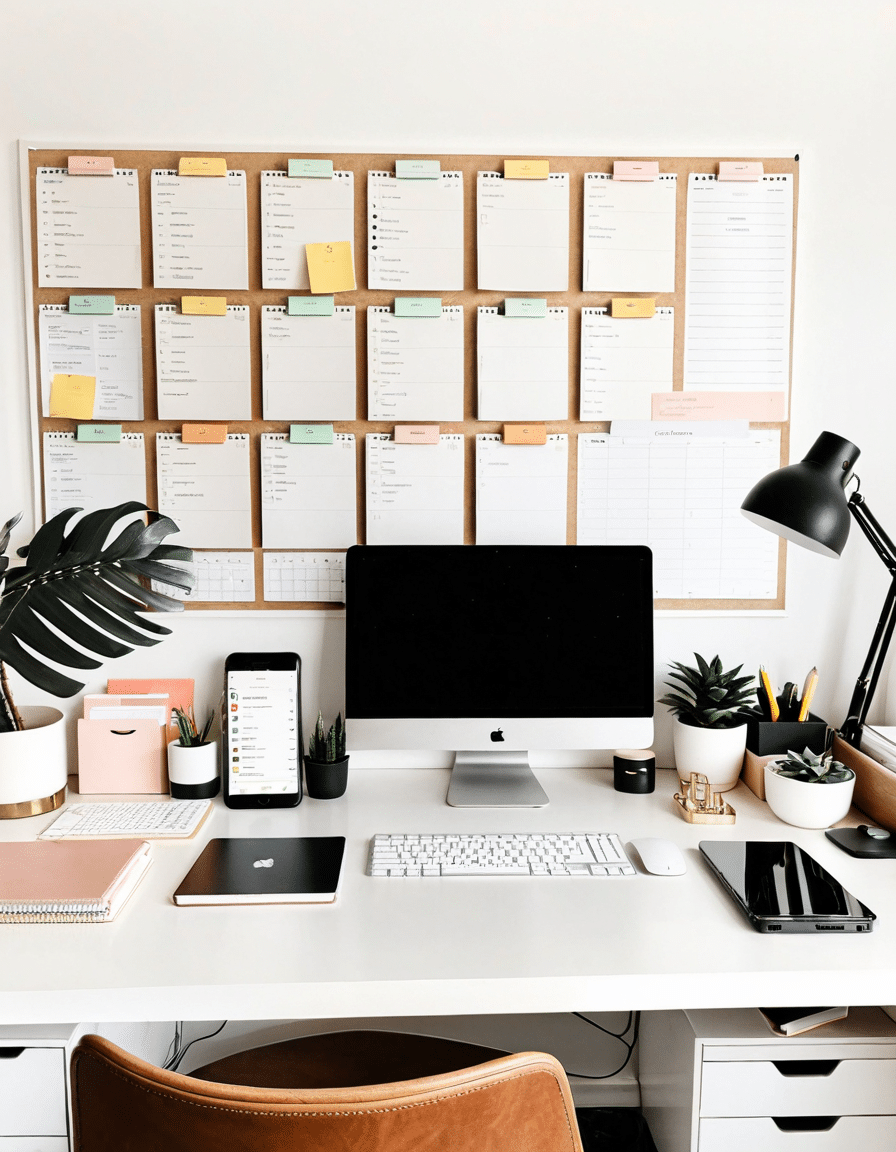

7. Advanced Digital Banking Solutions

In today’s digital age, technology matters. AllSouth has heavily invested in its tech offerings, delivering an outstanding mobile app that includes features like mobile check deposit and biometric log-in. Members find AllSouth’s app easy to use, especially when compared to Centra’s digital solutions, making banking feel less like a chore and more like a breeze.

2. Comparing AllSouth Federal Credit Union and Centra Credit Union: A Member’s Perspective

When eyeing membership in a credit union, it’s essential to compare and contrast the benefits offered by different institutions. AllSouth Federal Credit Union and Centra Credit Union each come with their own flair, so let’s break it down.

Interest Rates and Loan Offers

While AllSouth boasts competitive rates for home and auto loans, Centra provides its own gems, such as shared secured loans that AllSouth doesn’t offer. For members who have specific needs, these unique offerings from Centra may be the better fit.

Membership Eligibility

AllSouth casts a wider net for potential members, allowing individuals from various counties across South Carolina to join. In contrast, Centra narrows its focus, catering to a specific community market. For those who may find themselves on the fringes of Centra’s reach, AllSouth could provide a perfect opportunity for great banking solutions.

Fees and Account Options

Both credit unions offer diverse account types, but the zero-fee checking accounts at AllSouth can be particularly enticing. Members can enjoy free tiered savings accounts, while Centra may impose certain fees that could weigh heavy on budget-conscious members. Opting for AllSouth can feel like a breath of fresh air when you’re watching every penny.

Community Involvement and Charitable Work

AllSouth takes pride in its community involvement, engaging with educational and health initiatives that uplift the locals. Members should take note of which organization resonates more with their values. After all, supporting community causes adds a layer of good feeling to your banking experience.

Embracing Member Benefits for Financial Growth

AllSouth Federal Credit Union rises above the pack with a rich array of member-focused benefits that can positively influence financial wellbeing. The combination of competitive interest rates and an engaging rewards program arms members with the tools they need to achieve financial success. However, whether you’re leaning towards AllSouth or considering the specialized services from Centra, being informed about these essential differences will guide you toward making the best choice.

With these advantages in mind, members can feel empowered about their financial decisions and their role in supporting local communities. As these credit unions evolve, they’ll likely adapt to meet changing needs, emphasizing both member service and community dedication. Don’t underestimate the importance of being a well-informed member of a credit union, as it plays a vital role in your financial journey.

So, if you’re ready to discover all the possibilities, jump into the AllSouth Federal Credit Union experience today!

For more engaging content and insights on various topics, including the fascinating world of finance and film like Richard Gere ’ s Wife and fun beauty tips like Paul Mitchell tea tree shampoo, be sure to check back on Money Maker Magazine. Stay tuned for more exciting updates!

Fun Trivia and Interesting Facts About AllSouth Federal Credit Union

A Bright Spot in Financial Services

Did you know that AllSouth Federal Credit Union isn’t just about banking? It’s also known for fostering a tight-knit community vibe, similar to the feel-good stories you’d find on shows like Young Sheldon—no need to search Where can I watch Young sheldon season 7 for the delightful family connections, as you can find that spirit mirrored in the values of AllSouth. The perks don’t end there; members often use their benefits for everything from saving for a summer getaway to buying that dream home. Plus, many members can take advantage of exclusive promotions and rewards tailored just for them.

A Commitment to Giving Back

AllSouth Federal Credit Union also believes in giving back. A fun trivia tidbit: they actively support local charities and educational initiatives, embodying the spirit that we often celebrate in phrases de amor that highlight community and connection. Whether it’s sponsoring a local sports team or contributing to scholarships, AllSouth makes sure their contributions resonate within the community. It’s this commitment that draws many to become part of the AllSouth family, eager to experience the goodwill that comes with every member benefit.

Celebrating Unique Achievements

Furthermore, AllSouth Federal Credit Union prides itself on being member-focused in an industry filled with big players. Anecdotes float around about how their personalized service rivals even popular figures like William Hung, who proved that anyone can shine with the right support. Their ambition to maintain an approachable atmosphere, while providing stellar financial products, sets them apart. And just like the beloved character Beth from Yellowstone, AllSouth embodies grit and determination, aiming to empower members in their financial journeys.

If you’re curious about what other credit unions offer, you might want to check out Pioneer Federal credit union and see how they stack up. But no matter where you look, AllSouth Federal Credit Union is making waves in member satisfaction, proving that with the right approach, banking can be a rewarding experience.