![Square For Small Business: Is Square Right For You? [Square Explained]](https://www.moneymaker-magazine.com/wp-content/cache/flying-press/1adcde52ce8747436980c32aa34c9060.jpg)

Understanding Square Payment: A Game-Changer in Financial Technology

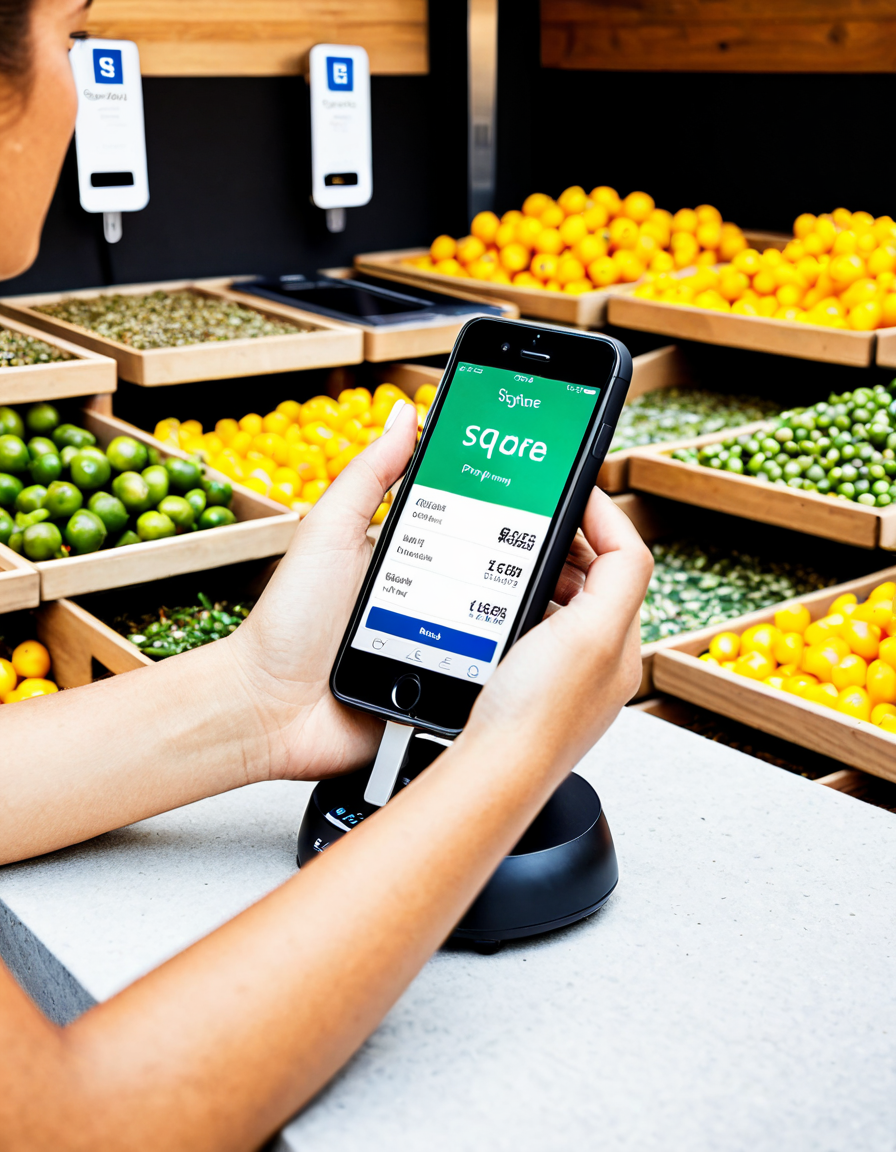

Square Payment has fundamentally altered the landscape of financial transactions for businesses since its inception. Founded by Jack Dorsey, co-founder of Twitter, and Jim McKelvey, Square has evolved from a simple mobile payment solution to an extensive financial ecosystem catering to a diverse range of business needs. Its technology integrates seamlessly with various point-of-sale systems, allowing businesses—from local coffee shops to large retail chains—to accept payments effortlessly.

By leveraging data analytics, accessible user interfaces, and a commitment to security, Square Payment has empowered small businesses and entrepreneurs. As of 2026, the platform boasts over 2 million sellers, showcasing its wide-ranging influence on how companies process payments. The ease of use and comprehensive features make Square Payment an attractive choice for businesses striving for efficiency.

With the advent of mobile payment technology, Square has positioned itself at the forefront of this shift, changing how consumers and business owners interact in terms of financial transactions. In fact, the platform has attracted businesses of all types, from small boutiques to larger enterprises. Take, for instance, innovative brands leveraging Square’s tools to grow significantly, such as digital-savvy companies like Bonobos, which have streamlined their payment collections.

Top 7 Transformative Features of Square Payment for Businesses

Square Payment’s POS systems offer a multitude of features beyond simple transactions. Businesses like Blue Bottle Coffee benefit from inventory management, employee usage tracking, and customer engagement analytics within a single system. This integration simplifies operations and provides a comprehensive view of business performance.

The Square Payment platform is optimized for online sales, allowing brands like Bonobos to provide a frictionless checkout experience. Through tools like Square Online, these businesses can easily set up e-commerce storefronts, leading to increased sales and improved customer experiences. The flexibility of Square also accommodates varying business models, ensuring versatility.

Square’s robust analytics tools equip businesses with essential insights that drive strategic decision-making. For example, a retailer leveraging Square’s reporting features can pinpoint peak sales times, enabling better staffing and inventory management during busy periods. This real-time data empowers business owners to adapt quickly and stay competitive in fast-paced markets.

Square Payment allows small businesses, such as freelancers and consulting firms, to send professional invoices directly through the app. This feature streamlines accounts receivable, resulting in quicker payments and improved cash flow. Businesses are no longer encumbered by traditional invoicing hurdles, allowing them to focus on growth.

Square empowers businesses, like Thrive Market, to implement loyalty programs effortlessly. By incentivizing repeat purchases through rewards, companies can significantly enhance customer retention and subsequently boost overall sales. Building loyalty not only increases revenue but also fortifies brand identity.

Square Capital stands out as a noteworthy feature, offering financing to eligible businesses. This option has supported companies like The Pie Hole in expanding or adapting to new market demands, providing quick access to funds without the red tape typically seen with traditional loans. The ease of securing financing can be a game-changer for many small businesses.

Security remains paramount for Square; they employ encryption and fraud detection protocols that inspire trust. Businesses such as Sweetgreen rely on Square Payment’s security measures, assuring customers that their transactions are safe. This confidence not only drives customer loyalty but also elevates the brand’s reputation in a competitive space.

![How to Take Contactless & Chip Payments | Square Reader Setup Tutorial [2023 Version]](https://www.moneymaker-magazine.com/wp-content/cache/flying-press/0721701b79af38917bb3a3815bed45c0.jpg)

The Future of Transactions: What’s Next for Square Payment?

As 2026 unfolds, the innovators behind Square Payment continue to explore advanced technologies, including artificial intelligence and blockchain, aiming to further enhance transaction capabilities. Intelligent solutions could provide enhanced fraud detection and personalized customer recommendations based on purchasing history, revolutionizing the customer experience. The opportunity to tap into AI-driven insights means businesses can anticipate user preferences more efficiently.

Moreover, as mobile wallets gain prominence, forecasts indicate that Square Payment will forge partnerships with platforms like Apple Pay and Google Wallet, ensuring its relevance in a rapidly transforming landscape. Collaborating with established players enhances Square’s reach, offering users seamless payment experiences across multiple channels.

In a landscape where digital transactions are increasingly the norm, Square Payment stands out as a pioneer. By seamlessly blending innovative technology with user-centric design, it has empowered thousands of businesses to thrive in a competitive marketplace. As we gaze into the future, Square Payment is primed to play a pivotal role in shaping commerce, establishing a foundation for financial technologies focused on agility and enhanced customer interactions. Embracing these shifts is critical for businesses eager to harness the full potential of today’s financial ecosystems.

In conclusion, the impact of Square Payment extends beyond its immediate functionalities; it embodies a broader movement toward accessibility and efficiency in financial transactions. The road ahead promises further changes to how we manage money and conduct commerce, paving the way for exciting opportunities for businesses willing to adapt and grow. So, buckle up and get ready; the future of transactions is here!

Square Payment: Fun Facts and Trivia You Didn’t Know

A Game-Changer in Transactions

Did you know that the concept of the square payment system came about to make transactions easier for small business owners? Before Square, small merchants frequently faced difficulties with traditional payment methods. This transformative technology was launched in 2009 by Jack Dorsey, co-founder of Twitter, and Jim McKelvey. Interestingly, Dorsey initially struggled to pay a glassblower friend for a piece of art when square payment emerged as a solution! It’s like how some of The office Actors found their breakthrough roles—sometimes, innovation stems from everyday problems.

Square Payment and Pop Culture

The rise of square payment is almost like a plot twist worthy of Gravity Falls dipper. Since its inception, the app has grown exponentially, processing millions of dollars in transactions daily. It’s fascinating to consider how technology interlinks with our daily routines—much like the popularity of the Jordan 4 Oreo sneakers, which have become iconic in their own right. Square’s integration of mobile payment systems allows businesses to accept payments anywhere, much like how consumers access films on Tamilblasters anytime, anywhere.

Evolving with Style

Square payment has even adapted to fit various industries, reminiscent of the multi-functional design of Lululemon Abc pants. These pants, known for their versatility, just might mirror the flexibility that square payment provides to business owners. And let’s not forget about Square’s innovations in marketing and analytics—attributes that help steer companies toward growth in a dynamic economy. It’s akin to how the clever storytelling in The Plex captivates audiences and drives engagement. Square payment doesn’t just revolutionize transactions; it creates a movement, offering businesses tools to flourish like Modio’s personalized fitness experiences that really step up your game.

In closing, the impact of square payment goes beyond mere convenience. It reshapes the everyday business landscape while reminding us that it’s often simple solutions that make the biggest difference. Just as Princess Diana’s revenge dress made headlines for its striking presence, Square’s influence continues to make waves in how we conduct business today. With tools like Deepercom, the future of payments looks bright—and square!