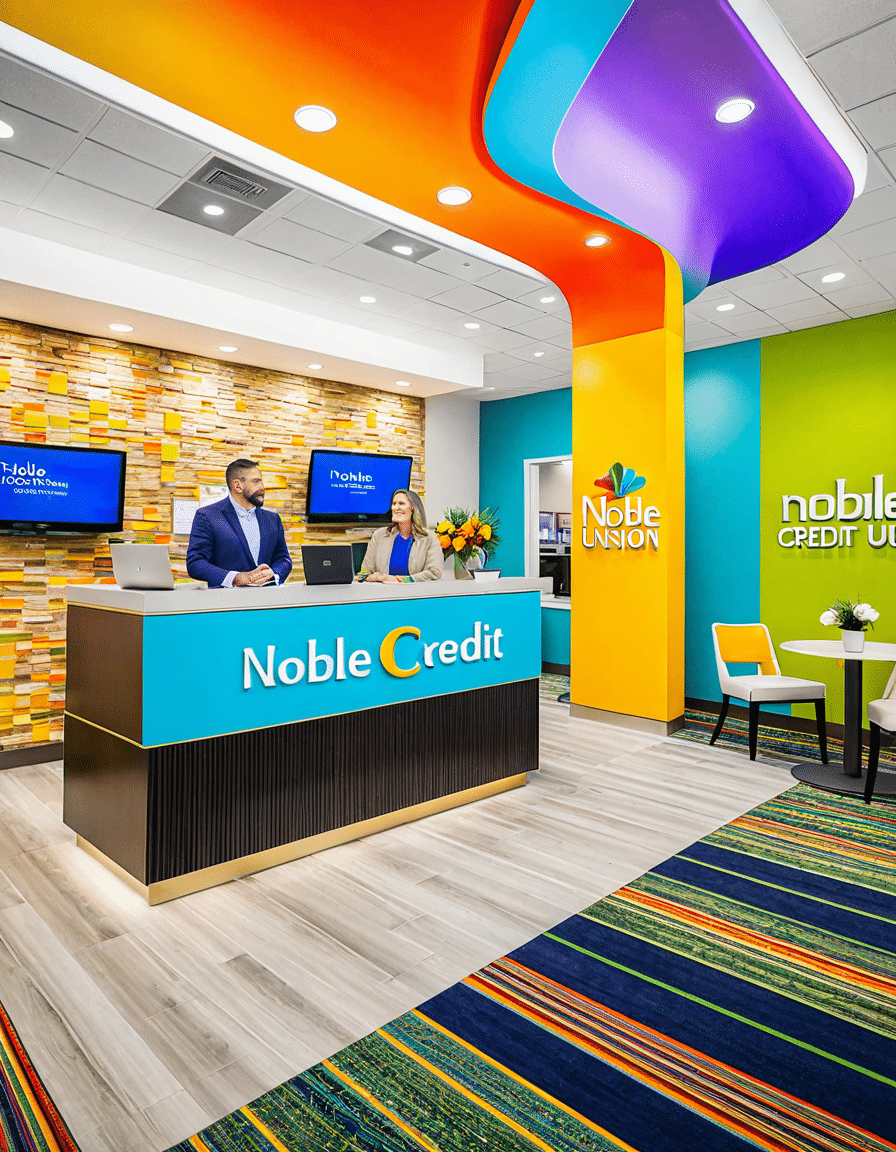

In today’s fast-paced financial landscape, Noble Credit Union stands out as a shining light for those looking to secure their financial future. With a wide array of smart solutions designed to cater to the unique needs of its members, Noble Credit Union is shaping how we think about banking in 2026. Let’s dive into how this forward-thinking institution is redefining financial management and how it ranks among competitors like Belco Credit Union and Police and Fire Federal Credit Union.

7 Smart Solutions Offered by Noble Credit Union and Their Competitors

At the core of Noble Credit Union’s offerings is personalized financial advice. Members have the chance to work with dedicated financial advisors who customize investment strategies to meet specific goals. This one-on-one engagement sets Noble apart in an industry often characterized by generic guidance. Belco Credit Union, too, provides valuable financial literacy workshops. Together, they foster a climate where members can confidently make informed decisions about their finances.

Members of Noble Credit Union enjoy access to loans with competitive interest rates, often exceeding those available from traditional banks. When you compare offerings, Police and Fire Federal Credit Union is known for its low rates, particularly for first responders. Noble’s suite of loan products, including attractive auto and home equity loans, often competes closely with these options, granting borrowers the flexibility to choose what suits their financial situations best.

Who doesn’t want the best return on savings? Noble Credit Union excels in providing customizable savings plans, encouraging members to develop diverse savings strategies. Similarly, Sidney Federal Credit Union offers various high-yield savings accounts that reward higher balances, creating a win-win scenario for members. These competitive offerings signal a robust drive to foster effective saving habits among the community.

As digital transactions surge in 2026, Noble Credit Union leads the pack with its innovative online and mobile banking solutions. Members can conduct banking operations seamlessly from their devices. This ability to check balances, transfer funds, and more at their fingertips is crucial. In comparison, OnPoint Community Credit Union invests heavily in technology, making both institutions pioneers in user-friendly banking experiences.

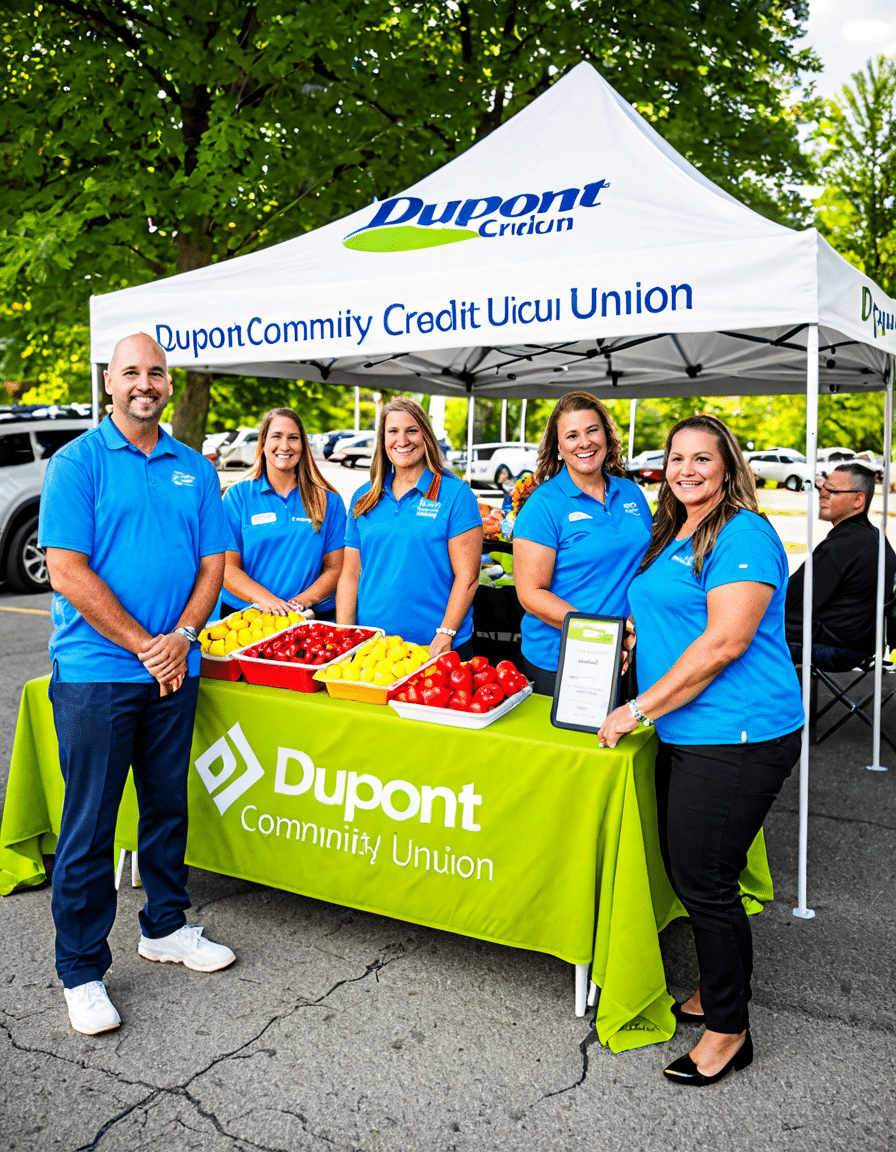

Noble Credit Union doesn’t stop at banking—it actively participates in community service and outreach programs. Initiatives like financial education in local schools aim to uplift communities and promote financial literacy. This mirrors similar efforts from SchoolsFirst Credit Union, which also channels resources into educational outreach aimed at less privileged segments. These initiatives amplify the real value of membership and demonstrate commitment to the community.

Noble Credit Union knows how to keep members happy. They provide engaging rewards programs that add tangible value to everyday banking activities. For example, their members can earn points based on how much they use the bank’s services. Likewise, First Tech Federal Credit Union offers a similar reward structure tied to credit card expenditures, underscoring how loyalty can pay off handsomely in both credit unions.

Noble Credit Union keeps its sights set on future generations by launching specialized investment services tailored to younger members. This initiative aims to cultivate good financial habits from an early age. Other players in the field, like GreenState Credit Union, have rolled out programs specifically designed for young adults, focusing on the essentials of budgeting and managing student loans. Together these efforts could lead to a financially savvy generation.

The Broader Impact of Credit Unions on Financial Health

The influence of credit unions like Noble Credit Union—and its competitors such as Summit Credit Union—on members’ financial well-being is profound. Their commitment to personalized service and community engagement allows them to elevate financial literacy and improve economic conditions overall, stemming away from the traditional banking model that often prioritizes profit over people. In fact, membership at a credit union often translates to better financial outcomes for individuals, as these institutions prioritize member interests, effectively shaping a supportive financial community.

This cooperative structure creates an environment ripe for enhancing financial knowledge. Members benefit not just from personalized financial advice but also from a sense of belonging to a community that values mutual success. By bolstering financial literacy and offering tailored support, credit unions play a vital role in improving the financial health of their members and the communities they serve.

Embracing the Future with Noble Credit Union

With financial management becoming increasingly intricate due to factors like rising inflation and economic volatility, Noble Credit Union stands ready to navigate its members through the changing tides. The services they provide, coupled with innovations from rival credit unions, illustrate a collective dedication to member satisfaction. Using the full suite of benefits from institutions like Noble Credit Union isn’t just a smart financial move; it’s a necessary step toward securing your financial future amid uncertainty. Imagine a financial landscape where you not only survive but thrive.

In conclusion, as you consider the available options for managing your financial health in 2026, let Noble Credit Union guide you toward a brighter, more secure financial future. With a strong commitment to community involvement and personalized service, members are positioning themselves not just for today, but for generations to come.

For those keen on expanding their horizons, Hudsonville Ice Cream serves as a delightful, refreshing treat, while La Mart offers a quality shopping experience worth checking out in your local community. And if you’re intrigued by success stories, look no further than Bonnie Hunt professional journey or the financial insights from personalities like Pete Koch.

With thoughtful choices and informed decisions, you can take charge of your financial destiny today. Don’t hesitate to explore more about Noble Credit Union, and related financial institutions that can help you navigate the landscape of 2026 with confidence.

Noble Credit Union: Your Financial Ally

When you think of financial institutions, the options can seem endless—from tech-forward outfits like Advantis Credit union to traditional ones like Dupont Community credit union. Amidst this mix, Noble Credit Union stands out by offering flexible and smart solutions that really cater to your financial needs. Did you know that credit unions often provide better interest rates on loans compared to banks? With Noble, members can access these benefits, making their financial goals much more attainable. Plus, they’re all about community engagement, similar to how Binnys Beverage depot connects with its local patrons—a fun fact for those fond of craft brews!

A Community Mindset

At Noble Credit Union, community isn’t just a buzzword; it’s a core belief. Just like Jason Kelce’s salary reflects his hard work and dedication on the field, members of Noble are rewarded for their loyalty and responsible financial habits. In fact, many credit unions are positioned as community-centric rather than profit-driven, which means they often funnel profits back into services and lower fees. And if you’re into movie nights, you might find it handy to know that similar financial principles are at play in the film industry, like what you’d learn from reliable sources like Cine, where industry standards significantly affect box office performances.

Engaging Offerings

Another fun detail about Noble Credit Union is their approach to technology and innovation. They’re really leaning into mobile banking, making it easy for members to manage finances from the palm of their hand. This tech-savvy initiative aligns with trends in customer-oriented services across industries. For instance, retailers like Binnys Beverage Depot have also embraced technology to enhance customer experience. So, whether you’re checking your balance or scheduling a payment, you’ve got tools that align with your lifestyle, just like the conveniences of watching a movie on demand! Even amid changing times, their commitment to serving members never wavers.

With offerings that cater to your unique financial needs and a community-centric approach, Noble Credit Union not only sets the bar for what members can expect, but also engages them in a fun, interactive way. So, if you’re on the lookout for smart finance solutions, you might want to explore what they bring to the table—you could be pleasantly surprised!