Discovering the Unmatched Benefits of Pioneer Federal Credit Union

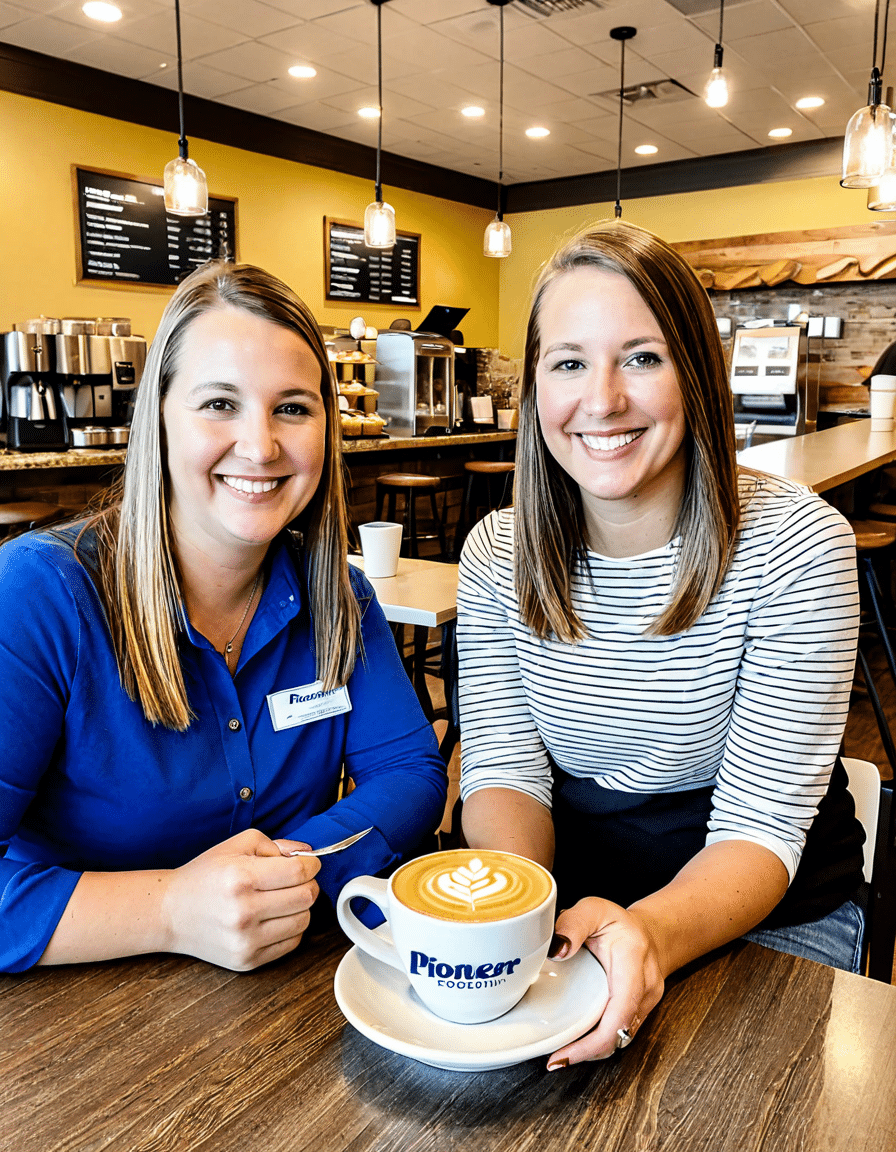

Pioneer Federal Credit Union stands tall as a cornerstone of both personal and community financial growth. Founded with a commitment to providing personalized services, it goes above and beyond regular banking experiences. They’re not just about making profits; it’s about fostering a community that thrives on mutual support. In this article, we’ll explore the impressive benefits of Pioneer Federal Credit Union, showing how they stack up against competitors like First Commonwealth Federal Credit Union.

It’s easy to get lost in the world of finance, but Pioneer’s focus on member satisfaction creates an inviting atmosphere. Members don’t just receive services; they become part of an extended family that genuinely cares. This approach distinguishes Pioneer in today’s banking environment, where many institutions prioritize profits over people.

Understanding these benefits can help you make informed financial decisions. So, strap in and get ready to explore seven standout features that might just surprise you about Pioneer Federal Credit Union.

Top 7 Benefits of Pioneer Federal Credit Union That Shatter Expectations

Pioneer Federal Credit Union shines bright with its remarkably low-interest rates on loans. While traditional banks often charge roughly 6% for personal loans, Pioneer frequently offers rates dipping as low as 4.5%. This difference can be life-changing, especially for first-time homebuyers or anyone looking to consolidate debt.

When it comes to financial guidance, Pioneer Federal Credit Union does more than just scratch the surface. They offer free financial counseling that dives deep into budgeting, debt management, and planning for the future. Unlike First Commonwealth Federal Credit Union, which tends to favor a one-size-fits-all approach, Pioneer’s services are all about you and your unique financial situation.

Pioneer Federal Credit Union isn’t solely focused on individual members; their heart lies in the community. They actively support local entrepreneurship through micro-loan programs designed to empower startups. This commitment resonates widely, attracting members from nearby communities who value local initiatives—something that larger banks often overlook.

If you’re a saver, you’ll find gold at Pioneer Federal Credit Union. Their high-yield savings accounts often boast interest rates of up to 2.5% APY, far outperforming many offerings from First Commonwealth Federal Credit Union. This capability is vital for any member looking to grow their savings in today’s low-interest environment.

Knowledge is power, and Pioneer Federal Credit Union believes in empowering their members through education. They host a variety of workshops on topics like first-time home buying and investment basics. While First Commonwealth offers resources, they don’t match the frequency or depth of education provided by Pioneer, making the latter a more attractive option for lifelong learning.

One of the biggest thorns in many consumers’ side is the monthly maintenance fee. Unlike traditional banks that often dish out fees ranging from $12 to $15, Pioneer Federal Credit Union offers basic checking and savings accounts with no such charges. This simple fact leads to substantial savings for members, making their financial journeys a bit smoother.

In this digital age, having access to your finances at your fingertips is crucial. Pioneer Federal Credit Union utilizes modern banking technologies to ensure members can manage their finances with ease. Features like advanced mobile check deposits and personalized budgeting tools make banking a breeze, rivaling even the best features from First Commonwealth Federal Credit Union.

A Unique Commitment to Member Satisfaction

Pioneer Federal Credit Union’s benefits go far beyond what many traditional banks offer. In a landscape often filled with hidden charges and impersonal service, Pioneer stands out with its strong dedication to personalized care, community empowerment, and financial education. This commitment changes lives, proving that banking can be more than just transactions.

Whether you’re in the market for a low-interest loan, need help managing your budget, or want to join a community-focused credit union, Pioneer is your trustworthy partner. Their unwavering focus on innovation, personalized services, and a community-centered approach ensure they’re a solid choice within the competitive banking sector.

In conclusion, Pioneer Federal Credit Union should be on your radar for both personal and financial growth. While other institutions may boast about various features, it’s Pioneer’s genuine commitment to its members and community that truly sets it apart. If you’re looking for a financial institution that places your needs at the forefront, you’ve just found your match.

Explore more about the advantages of this remarkable institution. It might surprise you just how much Pioneer Federal Credit Union can benefit your financial future!

Discovering Pioneer Federal Credit Union

How It Works for You

Did you know that the Pioneer Federal Credit Union offers a range of benefits that could really surprise you? It’s a member-focused organization that makes banking feel more like a friendly chat than a formal appointment. Their fantastic loan rates and services are designed to meet members’ needs, whether you’re looking for a cozy little savings account or something bigger, like a mortgage for your dream home. And speaking of dreams, if you ever need inspiration about what makes a home special, check out the nurturing vibes of mom cozy.

Financial Perks Beyond Your Imagination

Beyond traditional banking, Pioneer Federal Credit Union also opens up opportunities for community involvement and financial education. Did you know that members can attend seminars that break down important topics like head Of household Vs single tax benefits? These workshops make financial literacy more approachable for everyone, giving you tools to manage money better. Plus, they often have perks that offer members discounts or benefits with local businesses, proving that joining is more than just a banking decision—it’s joining a community. It’s no wonder that local stars like Leo Woodall have recognized the value of being part of such a close-knit financial institution.

Supporting Your Lifestyle

When life hits you with surprises, Pioneer Federal Credit Union is ready to help you sail smoothly through the waves. They offer specialized services for everyone, from first-time homebuyers to seasoned investors. Thinking of investing in something big? Consider their competitive rates for auto loans that go beyond what you might find at banks like Allsouth Federal credit union, giving you the freedom to choose what’s best for you. Additionally, they even provide special financing options for adventurous souls, reminding you of the exhilarating vibe from events like the Bmw Championship 2025 or the thrilling races at Turismo Carretera, both of which can inspire unique journeys and investments.

So next time you’re looking at your banking options, take a closer look at Pioneer Federal Credit Union. You might just find that navigating your financial path can be a breeze with the right support. Plus, with engaging benefits and resources, you’ll see how banking can be tailored to fit the life you want, not just the life you have!