In 2026, Mission Credit stands as a beacon of hope for those wondering how to take control of their financial destiny. It’s not just about boosting your credit score; it’s about a holistic approach to financial wellness. As we hurtle through this ever-evolving economic landscape, understanding the essence of Mission Credit can empower you to make informed decisions that steer your financial future. With an array of strategies and tools aimed at fostering financial literacy, Mission Credit guides individuals toward achieving their personal financial goals.

Understanding Mission Credit and Its Impact on Financial Wellness

Mission Credit encapsulates a fresh paradigm in personal finance. It’s about equipping individuals with the knowledge and resources needed to navigate financial challenges effectively. As we move further into 2026, understanding what Mission Credit entails becomes more vital than ever. The services it offers are designed to cater to the diverse needs of today’s consumers, especially in an age where financial literacy is paramount.

Having tools that enable better decision-making can significantly impact your overall financial health. Imagine having access to services like Identity Guard, which not only monitors your credit but also safeguards your information comprehensively. This kind of proactive measure is crucial in a world where financial scams and identity theft run rampant. Moreover, organizations are shifting their focus toward educating consumers, which helps in building trust and loyalty—elements that are essential in financial interactions.

In times of economic strain, it becomes crucial for individuals to grasp the myriad ways to enhance their financial stability. Mission Credit empowers people to rethink their approach to finance, aiming for an inclusive financial ecosystem where success is within reach. Addressing the financial needs of different demographics enables the creation of a more balanced economic landscape, which is beneficial for everyone.

Top 7 Mission Credit Strategies for Achieving Financial Empowerment

Mission Credit champions several essential strategies to help individuals attain financial stability. Here’s a rundown of the top seven techniques you should consider implementing:

The Evolution of Mission Credit Solutions Amid Economic Challenges

As the financial landscape continually transforms, it’s essential to understand how Mission Credit has adapted to meet the challenges posed by recent economic upheavals. The years between 2020 and 2023 reshaped numerous industries, and Mission Credit emerged stronger, fueled by technology and an educational approach.

The rise of financial technology heralds a new era. Innovations, such as AI-driven platforms like Experian’s Boost, offer personalized credit advice, shifting the traditional landscape of credit scoring. This dynamic approach makes credit truly responsive to individual behaviors and needs.

At the same time, organizations are increasingly realizing that consumer education is equally as important as the financial products they provide. By focusing on educating their clients, brands like American Express have deepened customer loyalty. Strong educational resources create an informed customer base, making for more sustainable financial relationships.

The Vision for Financial Inclusion: A Future with Mission Credit

Looking ahead, Mission Credit embodies a vision where all individuals can imagine financial success—no matter their background. This inclusive approach not only enhances personal wealth but also works toward narrowing the economic divide, which is a significant concern in our society.

Innovative Changes on the Horizon

Imagine a future where advanced analytical tools and machine-learning algorithms accurately predict financial behaviors. Companies pouring resources into these technologies can offer truly customized solutions. This personalization will pave the way for healthier financial habits, ultimately redefining what financial success means in the coming years.

A New Era of Financial Success

The current landscape of personal finance requires collaboration among organizations to ensure that everyone’s journey to success feels achievable. Mission Credit, through strategies like Identity Guard, functional freeze techniques, and progressive fintech options like MissionLane, is reshaping the dialogue on financial wellness.

Emphasis on education, tech integration, and community participation is addressing the financial struggles many face. As we continue grappling with contemporary challenges, the commitment to redefining financial success for everyone stands tall as Mission Credit’s prevailing mission. From individuals to communities, those who adopt these strategies will likely see their aspirations come to fruition.

In an age where information runs rampant, the importance of financial literacy is more vital than ever. Embrace the Mission Credit movement, and you won’t just survive; you’ll thrive in your financial journey!

Mission Credit: A New Take on Financial Success for Everyone

A Fresh Perspective on Financial Health

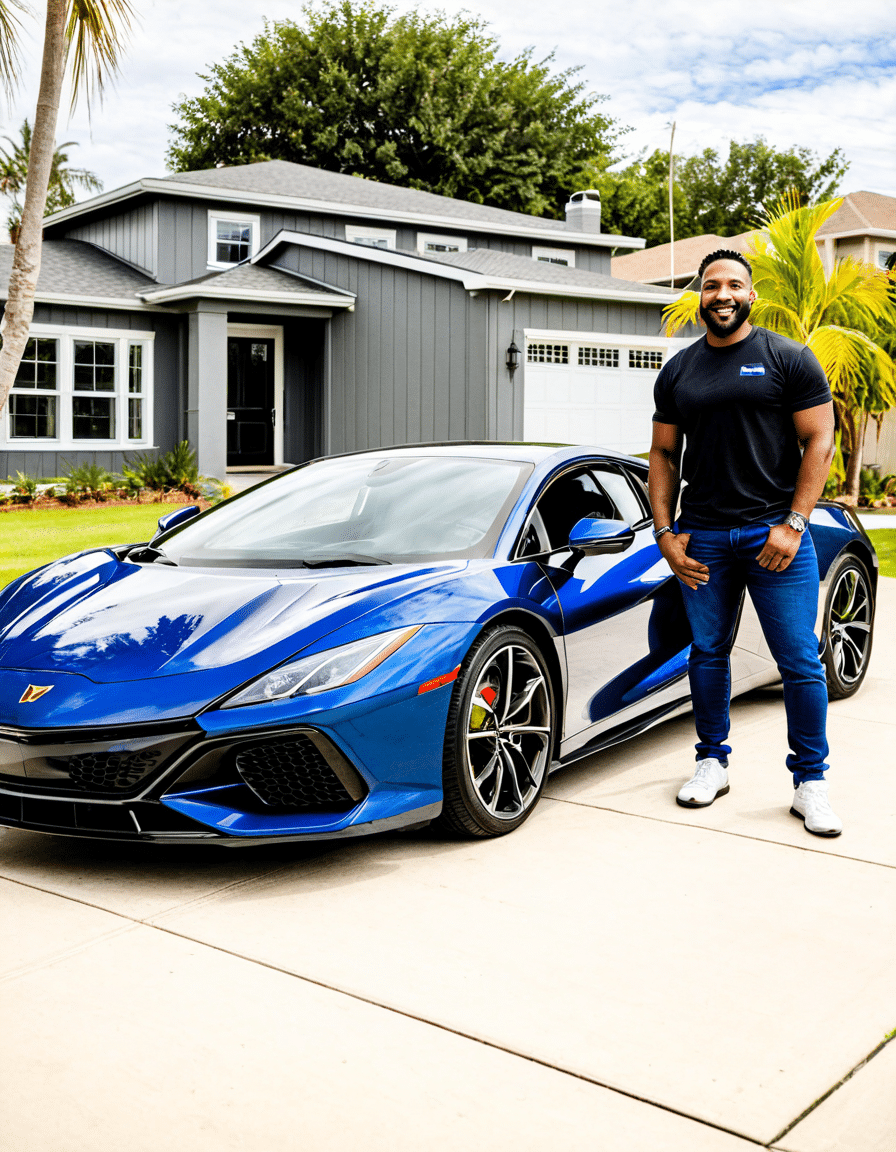

Ever heard of mission credit? It’s a game-changer in the financial landscape. This approach aims to make credit more accessible for everyone, emphasizing personal growth over traditional metrics. Did you know that by improving credit, you can actually save money and boost your purchasing power? Folks with better credit scores often secure lower interest rates, translating into significant savings over time. It’s like finding a hidden treasure in your budgeting!

Speaking of treasures, have you ever come across the Beltsville Abandon Factory? An eerie but fascinating site, it reminds us that sometimes, opportunities lie hidden in places we least expect. Just as this factory was once bustling with activity, new financial approaches can breathe life into your wallet. When you embrace the principles of mission credit, you unlock potential that benefits not just you, but also those around you.

Learning and Adapting for Success

Mission credit isn’t just about numbers; it’s about education and adaptability. Just like those who invest time in brisk teaching improve their learning experience, engaging with financial education can empower individuals to make informed decisions. The better you understand your financial standing, the more control you have over your future. In fact, many people have turned their financial journeys into success stories that inspire others.

Also, did you know that creative endeavors can influence financial decisions? Popular shows like Dimension 20 spark discussions about risk and reward, which are core concepts in finance. This kind of creative thinking plays a role in mission credit by encouraging people to think outside the box. So, whether you’re sporting a classic newsboy hat or catching up on the latest trends, remember that imaginative solutions can lead to substantial benefits.

The Humor in Finance

And let’s not forget the lighter side! Sometimes, aiming for financial stability can feel like a trip to the armpit of stress, but with a humorous lens, it becomes easier to tackle challenges head-on. Using a lighter attitude can open doors to better financial habits. By embracing mission credit, you not only improve your financial health but also learn to laugh a little along the way.

To wrap it all up, mission credit redefines how we view financial success. It’s more than just a numbers game; it’s about empowerment through education, creativity, and a sprinkle of humor. Each step you take towards improving your credit could lead you to exciting opportunities, just like diving into the fascinating world of literptica can open up new perspectives. Whether you’re in a tight spot or simply looking to enhance your financial journey, mission credit paves the way for everyone. So roll up your sleeves and get started!